The bright-line rule in New Zealand for residential property is very straightforward. It says you’ll pay tax when you buy and sell a residential property within ten years unless an exception applies.

Note we are mortgage advisers and can advise you on mortgage related questions. We recommend you engage specialist legal and tax help also.

New Zealand does not have a capital gains tax, but we do have an income tax. If the ird classifies you as buying and selling property with the intent of deriving income, it will add the income from property trading to your personal income and tax you. As it is classified as income it will affect not only your tax but also any other government payments or subsidies such as working for families, winz payments, accommodation supplements etc.

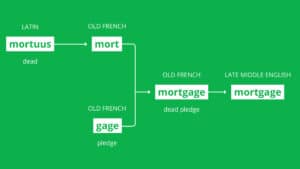

Historically in New Zealand, if you invested in property with the intent of selling that property at a profit you had to pay tax on the profit/income. Because it is very difficult for anyone to ever know why anyone does anything, it was also difficult for the IRD to know whether or not you purchased a property intending to sell it at a profit. In their infinite wisdom, they created an easier test, the bright-line rule. A bright-line rule is an existing term which means a clearly defined rule that leaves no room for interpretation.

You will have to file an IR-833 form where you calculate your net income.

Sale Price

Less Purchase Price

Less Deductible costs

= Net Profit/loss

Deductible costs are capital costs incurred in acquiring the property and capital improvements will generally be a deductible expenditure. You may not claim a deduction for private expenses relating to using the property as a dwelling. If you’re not sure whether an expense is deductible, we recommend you seek advice from a tax agent.

The Net Profit is classified as personal income (Other Income on your tax return). If you calculate a loss this is ring-fenced meaning you can’t automatically use it to pay less PAYE tax, but you can ‘save it’ for your next property sale.

Does the bright-line rule replace the old intention test? And when did it start?

The bright line test was established in three steps.

First, there was a two-year rule, which applies to properties purchased on or after 1 October 2015 through to 28 March 2018. Then the rule was updated to be five years for all properties purchased after 28 March 2018. Then the rule was updated to be 10 years for all ‘second hand’ houses purchased after 27 March 2021.

Note for new build houses they are still currently subject to only a 5 year bright-line test.

The intent test still applies to properties purchased before the bright line test commencement, and for property sales made after the bright-line period has ended. From the IRD: “If you sell a property outside of the relevant bright-line period for you, the bright-line rule won’t apply to your property sale. But the intention test may still apply. The intention test says you must pay tax on property profits if you originally bought a property with the intention to resell it. The intention test isn’t a new rule. It’s been around for a long time.”

What are the exceptions to the bright line rule?

- It’s your family/main home*

- You inherited the property.

- You’re the executor or administrator of a deceased estate.

And bonus, commercial property or farmland are also excluded, the bright-line rule only applies to residential property.

*Details about the main home exclusion.

- In bold at the ird website: The main home exclusion does not apply if you show a regular pattern of buying and selling residential property.

If you buy and sell your family home within ten years the income you earn from the sale of the property is not taxable if you used:

- the property as your main home continuously throughout the time period.

- if you change the use of the property for more than 12 months at a time within the bright-line period, ie renting it out for 18 months. YOu will have to pay a proportional income tax.

- more than 50% of the area of the property as your main home. This includes the yard, gardens, garage, pool areas and tennis courts, etc.

If you meet the above criteria, you’re eligible for the “main home exclusion” under the bright-line test. If you’re the trustee of a trust and the property is used as a residence by one of the beneficiaries of the trust, the main home exclusion can be applied when the property is sold.

Thinking of purchasing a new property – discover what you could afford with our mortgage calculators article and online calculators.