Anna Savage was the advisor that assisted my Mother and I in purchasing our first home. She was an absolute gem throughout the entire process. Her expertise, professionalism, and dedication made what could have been a daunting experience incredibly smooth and stress-free. From explaining the mortgage process to finding the best rates we were impressed with how Anna went above and beyond to help us get through the process. Her communication was prompt and clear, keeping me informed at every stage of the process. I couldn't have asked for a better mortgage broker. Thank heaps Anna!

Continued great experience with mhq, have used them for years for all of our mortgage and advise and they continue to be the best in the business!Can highly recommend Andrew and his team!

I absolutely cannot praise the team at MortgageHQ highly enough! Their hard work, communication, and dedication to assisting my fiancé and me were truly exceptional. The journey of purchasing our first home can be quite overwhelming, but the team made it incredibly smooth for us! As first-time homebuyers, we naturally had a lot of uncertainties, but Anna & Marcia were consistently available, even when I reached out late at night, to reassure me and address any concerns. I genuinely had nothing to worry about, thanks to their support. A huge thank you to MortgageHQ, with special recognition to Anna & Marcia. #clientforlife 🙂

After being discouraged by many mortgage brokers who informed me that I was not in a position to buy property on my own, I decided to give MortgageHQ a chance and Simon McDonald did not disappoint. Simon’s confidence in being able to secure a loan gave me confidence. I wholeheartedly recommend MortgageHQ to anyone who wants to explore options related to mortgages or property and a special thanks to Simon for his time and dedication to making it all possible.

Fantastic service by and efficient and professional team. Simon and his team know their stuff and are very responsive in answering questions. Most defiantly would recommend to anyone

Thanks to Ray and the team at MHQ. The financial advice that they provide to clients and educational YouTube videos and podcasts will empower you with knowledge for your personal and investment journey.

Awesome team, great advice, super fast to respond, can't rate MortgageHQ highly enough.

Definitely recommend MortgageHQ. My second time using them. For this one we did a mortgage refinance and the whole process was seamless. Done via emails, a couple of phone calls and zoom.Marcia and Yan made the entire process stress-free, and were more than happy to answer my questions. Very approachable and easygoing, pleasant to deal with and knowledgeable in their field. Huge help especially as working parents.

MHQ offer a great service. Our broker Zhiyang was professional, responsive, and understands the industry. Working alongside him was Kevin who kept us updated on progress with our applications. Highly recommend this business!

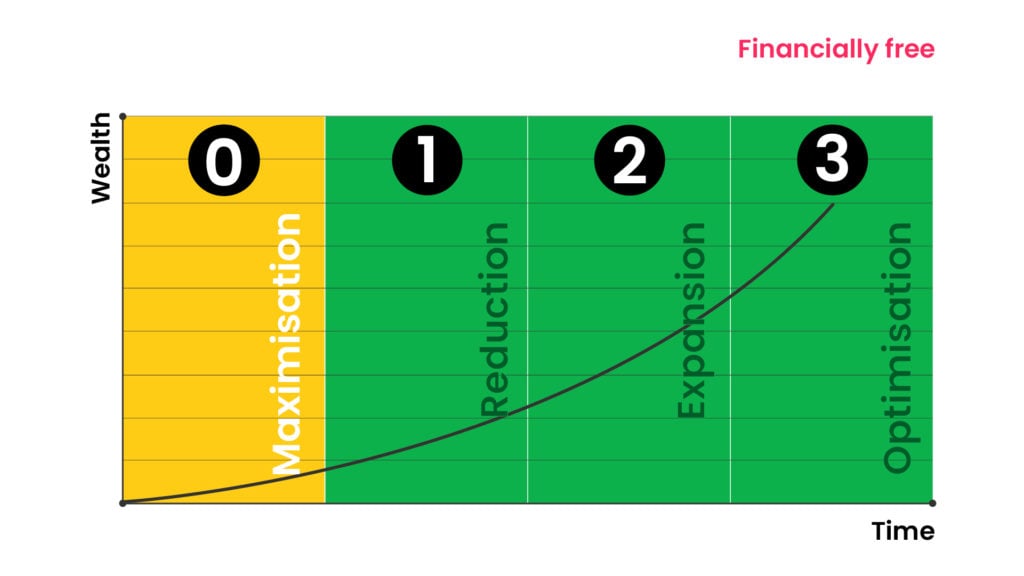

This is the first step in my journey to build equity and create passive income.What can I say, it was an awesome experience, when you are borrowing 100's of thousands of dollars you are as nervous as hell, will you make the right decisions, what bank will you use, and the list goes on.Right from the start where we talked about finances and whether we had enough to buy a house, to going through all the details to finalise the mortgage. There were a number of people helping but in the final parts Simon & Marcia helped us get over the line, in our most nervous times.This is a longer story, but to keep it as succinct as possible, we are really grateful for the help. We will definitely be back for step 2 of the journey.

A big thank you to Cairo who helped us made everything possible. He brought confidence, knowledge, honesty and professionalism. He planned out exactly what we enquired. Our processes with bank went on smoothly. Couldn't be happier.

Anna and the team were amazing! This was my first mortgage and they were so helpful every step of the way.

Frankie, Blandon and the team were great to work with and got me a great deal on finance. Highly recommend!

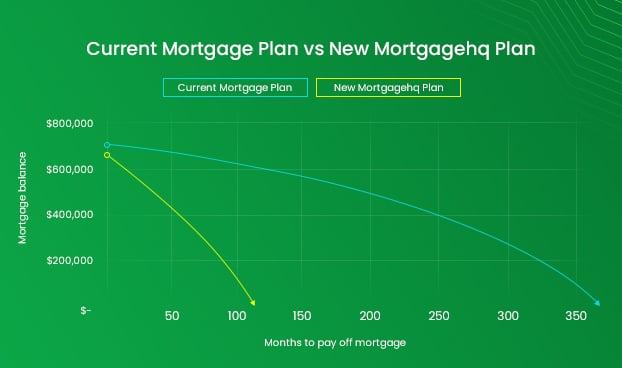

I've done my mortgage 5 years ago with David, and it was all very good. We've done a refinance a year ago to get better rates and a good cashback. The rates were better than what the banks offered at the time. Since then, I have been working with Ray Wang. Very recently, I was able to make offers without a pre-approval ready, with only requiring 3 working days on the finance clause. We got an offer accepted, and we've bought our second property. They move real quick when it matters. Thank you!

Remortgage Transition with Exceptional SupportI recently underwent a remortgage process, and I am pleased to share my positive experience with the team that facilitated the entire transition. Choosing to work with a third-party broker initially made me hesitate, but it turned out to be the right decision.Anna and Macia, as part of the team was instrumental in ensuring a smooth and hassle-free remortgage process. One of the standout aspects of their service was the ease of communication. Whenever I had queries or needed assistance, reaching out to them was quick and convenient.Dealing directly with the bank staff would have likely posed significant challenges, and I am grateful for the support provided by the broker. The team's expertise and responsiveness were invaluable, and I am confident that I made the right choice by entrusting them with my remortgage needs.In addition to the exceptional service, I also secured a better deal through their assistance. This added financial benefit and also, they did not charge any fees for their valuable assistance.Overall, I highly recommend this team for anyone!

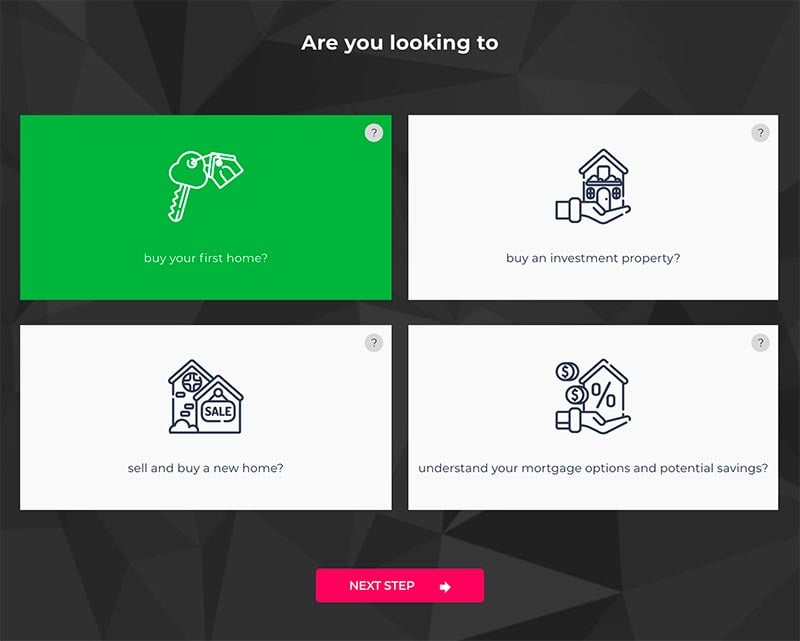

We had an amazing experience working with Yan from MortgageHQ. My husband and I initially watched their videos and took the mortgage lifecycle quiz. The next day I received a follow up and booked a call with Yan. At this time I was already in the process of working with a different mortgage broker who was local in my region. However, Yan added so much value through our discussion. He started by asking what my goals and aspirations are and my "why" for owning rental properties. This really resonated with me and it felt like he wasn't just trying to get my business but to help me achieve my "why" through these particular financial goals. My husband and I had quite a few different projects we were thinking about doing i.e. developing our two existing properties that have a bit of land. Truth is we weren't doing anything with the equity and savings we had because we didn't have a clear direction and pathway with the options we were considering. Yan provided some really great insights about the market and got us thinking in a different way, he opened up our mind to the possibilities so that we could consider alternatives. After a 30 minute conversation with Yan, I left with so much more clarity about our current rental portfolio, how to expand this to achieve our goals and our "why" and most importantly I felt empowered to take the next step and had a clear pathway of progression with our projects. The option came up to consider securing another property to build our portfolio and come back to developing our existing properties. We had never thought about this and thought this was many years down the track after the developments, but it made so much sense to try acquire more now while it was a buyers market as we could get a bargain and then benefit from the greater capital gains. Yan was great, he provided really clear next steps and worked with us over a few months to get together everything we needed to submit an application to the bank. My husband and I don't have straight forward income, it's a mixture of salary and business income, Yan made this process really easy for us. His colleague Marcia also really helped with this process. They were both available to chat and really quick with responding to emails when we had to get pre-approvals on properties. They enabled us to complete our due diligence on properties and finally secure a great deal - a block of units with 8% yield, which provided 4 rental incomes. It wasn't just their expertise and experience with mortgage broking, they understood the market and the nature of this business, and as relatively new investors this was really added value. They never made us feel inadequate when we had lots of questions or at any part of the process. We felt really comfortable asking all the questions we needed to and were always provided with great clarity and advice. We know that without our amazing broker Yan we wouldn't be in the position that we are in today and the future positioning this has set us up for. We couldn't recommend the service we have received from MortgageHQ enough! Anyone who asks us will be recommended to MortgageHQ.

Amazing team!!! Very helpful and very responsive

mortgagehq team was really helpful and professional. Especially, Simon was the best. I am really grateful for the support Simon had provided throughout the home loan process.

Ray understood our situation and what we were looking for and helped us achieve it.

As first home buyers, this service was perfect. With so many different things to coordinate, it was great having Kevin and Zhiyang to guide us through everything (and not to mention get us a good rate)

Responsive team. Had a great experience.

Simon and Marcia were great to work with. Very happy with the structure that they have provided for our loan and the assistance that they provided throughout the process. Looking forward to catching up with the team to continuously look at faster ways to pay off the mortgage.

Excellent help from the team, especially Jason Lai and Zhiyang. Very professional and helped us understand the process as we worked through it together. Made the process very smooth and ended up settling on our first property a few days earlier then initially scheduled. Many Thanks team!

Kevin & Zhiyang helped me with refinancing / switching banks. They go above and beyond, absolute pleasure to deal with and always on hand if you have any queries or issues. Highly recommend MHQ. A+++++

My broker Yan gave excellent advise and was patient with my endless questions. Overall I’ve had a great experience. Thank you!

The team was really helpful, professional and on top of things from the start. They connected with us at the right time and their holistic view of our property journey gave them a unique advantage when dealing with our main mortgages and borrowing profile. They got us where others could not, and with a smile! Thank you! We look forward to continuing our journey with you!

Right from the first contact, Zhiyang our mortgage advisor has been amazing, working through all our questions at our pace and making sure we understood what we going into. What we appreciated was the honesty and the options they provided to make things easier for us. But the biggest highlight for us is knowing that we have a better understanding of how to structure our mortgage, how to save better and how we can possibly pay our mortgage off faster, if we stick to the plan.

Blandon and his team expertly found us a cheaper option for our mortgage and a cash back.The move to a new bank was smooth and easy.. I would recommend mortgagehq servies.

Fantastic teamwork, very experienced and professional who know their stuff. They were able to get our refinancing across the line with the hardest bank to get lending. 100% highly recommend for any lending, refinancing and Financial wealth advice. And best of all we didn’t pay a cent! Thank you again MortgageHQ team.

Financial advisor, Mortgage advisor and Insurance advisor (Al, Anna & Andy) - A big thank you from us to you! I recommend them for all the above services.

Buying and Selling a home at the same time is quite a stressful process. Zhiyang, Kevin & Jason at mhq made this process super stress free. Got pre approval within 24 hours to start with. The hardest part was to submit an offer on a new house with minimal conditions. Once the offer got accepted, The team ensured that we got all final approvals in less than 3 days. Very highly rated team and we thank them from the bottom of our hearts.

Anna from mortgagehq was professional, very knowledgeable, understanding, and really good at explaining complex things in a simple way. I would strongly recommend her work; tēnā koe, Anna!

The team at MortgageHQ made buying my first home and navigating the whole mortgage process a breeze. Friendly, helpful and extremely informative throughout, I would highly recommend them to anyone looking to purchase a property.

I don’t think we would have been able to purchase our first home without mortgagehq’s help. We found the property (off the plan) we like at the time when property values were high and settled when property valuations dropped to around 150K below purchase price. Ray, our MA, had been great. He helped us get through a tricky situation and been with us all the way until we finally settled. He’s given us really good advices that helped us make good decisions and we’re very thankful for that. Ray was also well supported by Andrew and Blandon during the most trying times in the process so it’s really quite comforting to know that it’s not just one person, but a team helping us in the process. Thank you mortgagehq!

We bought our first property with the help of MHQ. We definitely recommend these guys as they are very professional and always keep you updated. Special mention and thanks to Yan and Marcia!

Cairo was amazing. Sad to see him leave but he put in the work for us to get the approval and the house. Marcia also was amazing in getting the last yards for final approval. Great team

Great experience throughout the process. I've contacted MHQ for my first investment property. The team have gone through all the details and provided valuable advice. Highly recommend to anyone who may need Financial assistance.

Both Zhiyang C & Kevin P have been a great team. They've provided awesome support & solutions to this novice. We're really happy & fortunate to be working with them as well as learn from this extremely knowledgeable and smart mortgagehq team & community as we build our portfolio

Great broker, highly recommend