Mortgage Calculators To Discover Your Home Loan Options Instantly Online.

Mortgage calculators are a great way to help you get the most out of your home.

They can help you figure out how much your home loan payments will be, and what kind of loan options are available for you. There are many different kinds of online mortgage calculators that can do everything from helping you buy a home to calculating your monthly payments once you already own one. Furthermore as mortgage brokers we have specific bank calculators for all the lenders we have relationship with (over 28). In this post, we’ll go over some common types of calculators and how they work so that all homeowners have access to them!

Please use the three free mortgage calculators available online. The mortgage snapshot is the most comprehensive tool we have publicly available. Calculating borrowing power, refix savings, UMI, usable equity and more.

Internally we also produce several breakdowns and spreadsheets for clients. To have someone assess your situation and calculate options to borrow more, restructure your mortgages to save money, reduce risk or reposition to achieve your wealth goals – get in touch today.

Mortgage Snapshot

Mortgage Repayment Calculator

Mortgage Free Calculator

mortgagehq's flagship mortgage calculator

In 2015, we created this tool to give people more information about mortgages. It can tell you your borrowing power and the options you have. The calculator also tells you how much you could save each month. The calculator will show your monthly mortgage, uncommitted monthly income (UMI), as well as other calculations. We also email your results with explanations.

This advanced mortgage calculator takes just 90 seconds to complete online – find your answers here.

The mortgage snapshot is a borrowing power calculator. It is more complicated than a repayment calculator which is simpler. This takes into account your personal situation such as how many dependents you have, how much debt you have, how much income you are earning, and your current mortgage and current equity position. Therefore it takes longer to complete and has many more inputs to fill out.

Warning: an online mortgage calculator will never be as accurate as a complete application review.

When building it we gathered information from the five major banks in New Zealand and compiled it. The results are not specific to one bank or lender but represent a holistic market estimate.

Our free calculator takes just 90 seconds to complete online – find your answers here by using the mortgage snapshot.

Scroll down to find links to calculators for borrowing power from each bank.

You know how to calculate how much interest you would have to pay – if not please reread further above. Now, we need to include paying off the principal (ie actually paying your mortgage off). In New Zealand, people usually choose a table loan – this means that your monthly payments will stay the same over the life of your loan. If you are looking for ways to reduce your repayments to increase your cash flow book a 10-minute call with someone from our team here.

At the beginning of the loan, you pay mostly interest. As time goes on, your mortgage balance decreases, so you will pay less and less interest. Towards the end of the mortgage, most money is going towards paying off your principal.

To calculate this you would use an amortization table. This is a table that recalculates your remaining mortgage balance after every payment. If you have a 30-year loan with weekly payments your table would have 30×52=1,560 rows! This is required as every repayment is unique in the amount of principal vs interest repaid.

Because of the complexity, I would suggest using either excel or google sheets to build an amortization table. Or just use an online calculator… like the one below! If you are determined to DIY your calculation here is a 22-minute youtube video that runs through how to build one in google sheets.

How much will the bank lend me? This is the hottest question out there. To work this out we need to work backwards. The first thing to understand is that banks want you to be able to pay them back and not default on your home loans.

Step one: calculating your available income.

The first thing banks calculate is how much you can afford to spend on your mortgage, they call this amount your Uncommitted Monthly Income (UMI). Essentially it’s how much money you have left each month after paying tax and for essentials like; insurance, food, clothes, transport, electricity, and other home loans. You can guesstimate this by doing your own budget (make sure you exclude any costs that will disappear like your Rent if you are buying a home).

Say your family earns $9,000 per month after tax. You subtract your expenses and you are left with $5,000 of uncommitted income each month (UMI).

Step two: what interest rate does the bank use to calculate affordability.

Banks do not calculate affordability/borrowing power using your actual interest rate. At the time of writing, interest rates were around 2.5%, but the banks are using ‘affordability test rates’ of between 5.5% to 6.5% (approximately). Note these change frequently and are different from bank to bank – speak to an adviser to see which bank would lend you the most money.

We take our example uncommitted monthly income (UMI) of $5,000 and multiply by 12 (there are 12 months in a year) to get an annual uncommitted income of $60,000. We then take our $60,000 and divide it by our test rate of 6.1%.

$60,000 / 0.061 = $983,606. This is approximately our example families borrowing power.

WAIT! This is only your borrowing power from a servicing or income perspective. The other part of the equation is having a big enough deposit. The bank will lower your borrowing power to whichever number is lower. For example, if our family was required to have a 20% deposit, and they had $150,000 to use they could only borrow $600,000. Meaning they could buy a \$750,000 house using a 20% \$150,000 deposit – even though their income would have allowed them to borrow up to \$983,606.

Mortgage Repayment Calculator

Use the mortgage calculator to instantly calculate your mortgage payments.

When banks calculate what you can afford to borrow which is known as your borrowing power, they use additional criteria and an alternative interest rate known as a ‘test interest rate’. To discover your borrowing power and more use the mortgage snapshot.

INSTRUCTIONS:

-

Loan Amount:Enter the lan you are considering getting. the house pruchase price less your deposit.

-

Rate:Enter your expected interest rate. To find out roughly what rate you could get, book a 10-minute call with an advisor.

-

Term:Enter the number of years you want your mortgage to be paid off over.

-

Loan Type: Principal & Interest loans are structured so you pay the interest and the total mortgage down, interest only loans you are paying interest only so your mortgage balance remains static.Payment Frequency:We suggest to pay your mortgage fortnightly.

Mortgage Free Calculator

When you set your original loan term your repayments will pay off your total mortgage exactly at the end of term. If you increase your repayments early on you reduce the total mortgage at the beginning of the term. This in turn decreases the amount of interest due in each payment – compounding your repayment by using more of it each payment to reduce your mortgage.

INSTRUCTIONS:

-

Loan Amount:Enter your current (or potential) mortgage balance.

-

Loan Term:Enter the number of years you have remaining on your mortgage (not your fixed term interest rate, but your actual mortgage).

-

Interest Rate:Enter your current interest rate - or the average rate you expect to pay over the future.

-

Payment Frequency:Enter your repayment frequency.

-

Extra Contribution Per Payment:Enter how much extra you could afford to pay on your repayments.

Watch the graph change and see: 1. how much interest you can save, 2. how many years earlier you can get mortgage free.

NZ Bank Mortgage Calculators

- Childcare - $1,000 per month

- Vehicle/transport - $800 per month

- Insurances - $250 per month

- Other costs - $700 per month

ASB Mortgage Calculator

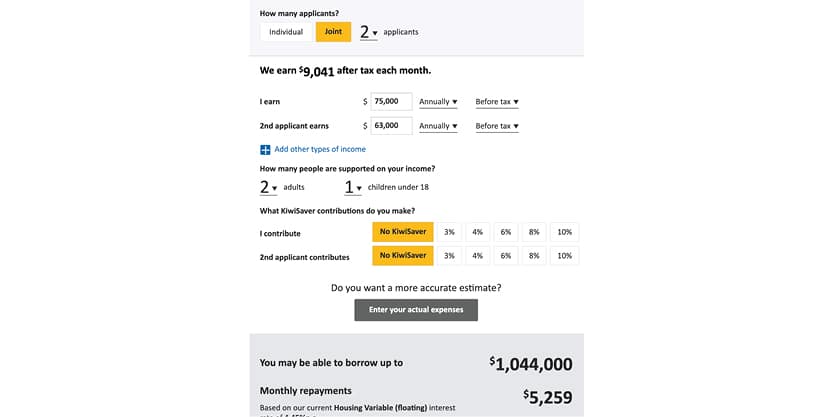

The ASB home loan calculator suggests our sample couple could afford to borrow up to $1,044,000. ASB bank also has a repayment calculator on their website.

BNZ Mortgage Calculator

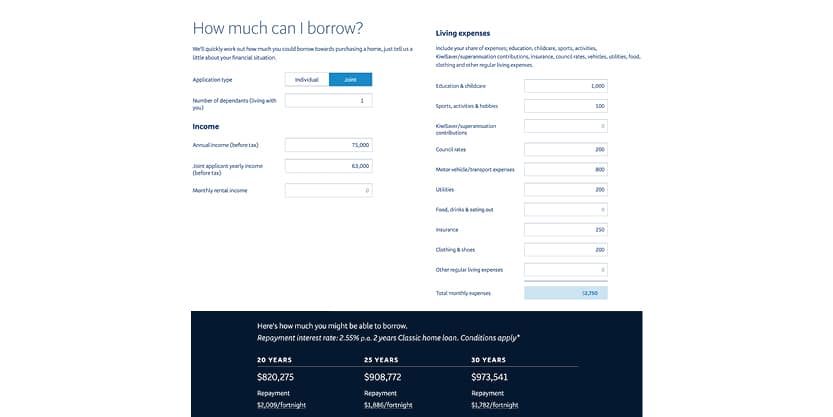

The BNZ home loan calculator suggests our sample couple would afford to borrow $973,541. BNZ bank also has a repayment calculator on their website.

Westpac Mortgage Calculator

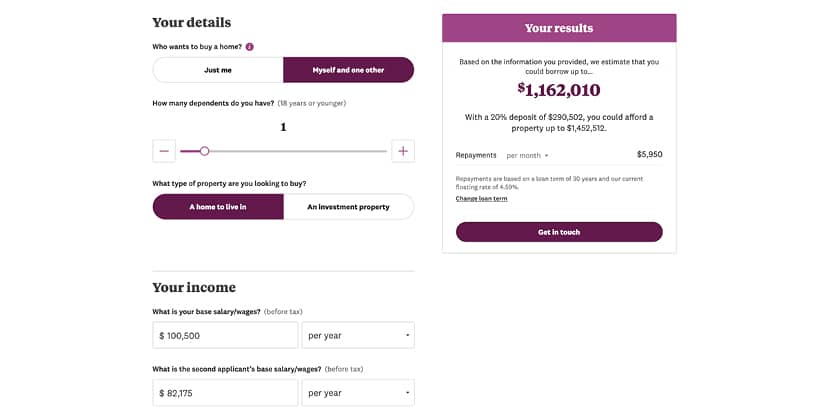

The Westpac home loan calculator suggests our sample couple would afford to borrow $1,162,010. Westpac bank also has a repayment calculator on its website.

ANZ Mortgage Calculator

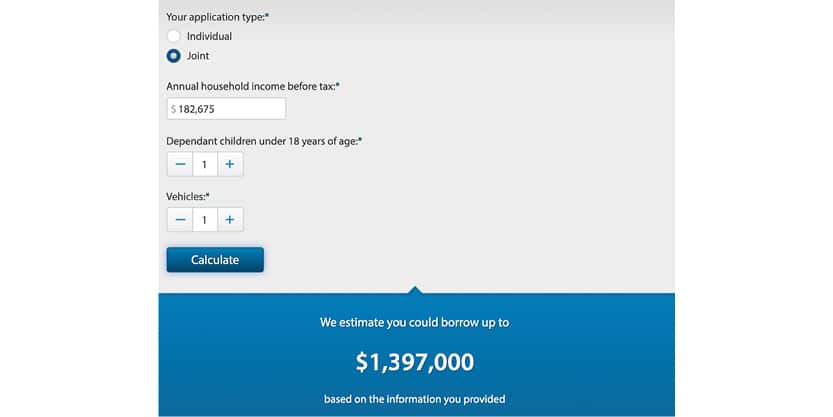

The ANZ home loan calculator suggests our sample couple would afford to borrow $1,397,000. ANZ bank also has a repayment calculator on their website.

Kiwibank Mortgage Calculator

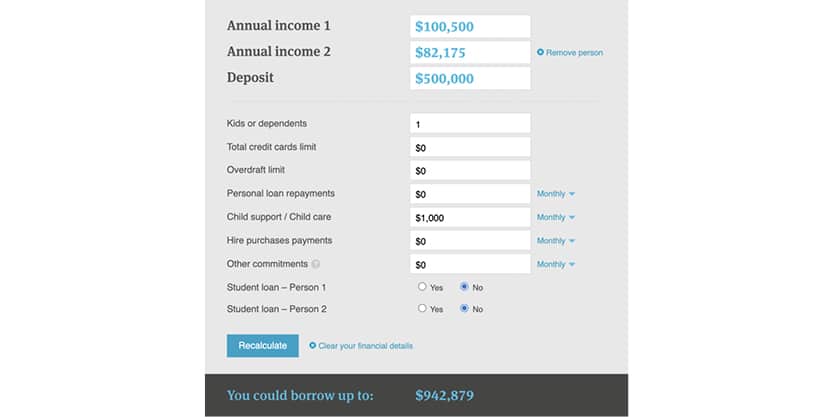

The Kiwibank home loan calculator suggests our sample couple would afford to borrow $942,879. Note I used a large deposit to ensure we weren’t limited by our deposit size. Kiwibank also has a repayment calculator on its website.

Wow! A half-million-dollar difference between banks!

These are just estimates from each banks’ website but even so, look at the difference the lowest estimate was $942,879 while the highest was $1,397,000 – just shy of a half a million-dollar difference.

That is why we always advise our friends and family to talk to a mortgage broker (adviser) – as you don’t know if your bank’s answer is representative of your options across the industry.

Remember there is a myriad of other differences between our banks:

- Servicing test rates

- Low equity fees (or low equity interest rates)

- Application costs

- How they treat commission

- How they treat rental income

- How they treat business forecasts

- Differences in lending for new homes/investments/new builds and construction loans.

Now you know!

How could competent advice and friendly service help you achieve your dreams? Perhaps our advisers are aware of a lender that can help you with your next steps. Book a 10-minute call with a team member here to get your questions answered.

- $300 has left your account, you are $300 poorer in cash.

- $300 gets paid off your mortgage, you are now $300 richer across your property portfolio.

- As your mortgage has reduced you will pay less interest in your next payment.

How to do the maths for your own mortgage calculator

Aahh Math! Don’t worry. Let’s start with the simplest calculations, then we will build on your understanding. We are not here to confuse you but to teach you and help you when you need outside advice.

How do you calculate your payments on an interest only mortgage?

An interest only home loan is easy to calculate. You are just paying the interest that is added to the loan, not any of the original loan. So, your loan will stay the same size over time.

First, we need to change our interest rate from an annual rate to match our repayments period. If you want to calculate weekly repayments, divide your annual interest rate by 52.

If your mortgage rate is 2.5% we divide it by 52 which gives us 0.048% every week.

You then take your total mortgage of $750,000 and multiply by 0.048% (expressed as a decimal rather than a percentage this would be 0.0048) giving us a weekly interest repayment of $360.