- Our Story

We started in 2015 to provide transparent advice and low rates to kiwis. Andrew explains the story and why NZ needed another mortgage adviser.

10,000 years ago families were fighting over caves as a place to keep their family warm and store their wealth.

Andrew and Blandon co-founded mortgagehq together in 2015.

Our advisers can achieve you fantastic results with the help of submission, servicing, and settlement specialists. Learn how our team works together for you.

Talk with our team

Book a 10-minute introductory chat. We can help clarify your current situation and immediate goals and match you with an adviser specialised in your situation.

- Advice Process

Choose a mortgage adviser to work with you, broker your mortgage, and help guide you to achieving your property, mortgage and financial goals.

What does a mortgage broker actually do for you? Can you trust them?

Learn what to expect and how we help at every stage of the process.

Current mortgage rates alongside historical data. Plus an explanation of factors you need to understand before choosing a bank and mortgage rate.

How much does it cost to work with us? What are your options to get a pre-approval? And what other options are available for you.

Find your Advisor

Book a 10-minute introductory chat, we can help clarify your current situation and immediate goals then match you with an adviser specialised in your situation.

- Learn Property Investing

We created this model to structure our education. Learn the typical pathway kiwis take to build their financial independence, identify your stage and what you should focus on now.

Watch and read from 100s of articles and videos covering topics such as ‘beginner mistakes to avoid’, ‘interest-only mortgages explained’, and much more.

All 3 stages in the mortgage lifecycle have a masterclass to unpack exactly where you are, what options you have now, and what strategies you should implement today.

Step by step instruction on how to build your portfolio. An extensive course with over 90 easy to digest videos, spreadsheet calculators, and access to an exclusive online community.

The first principles of the Property Formula Workshop over a 7-day sprint. If you are on the fence about the property formula workshop – start here.

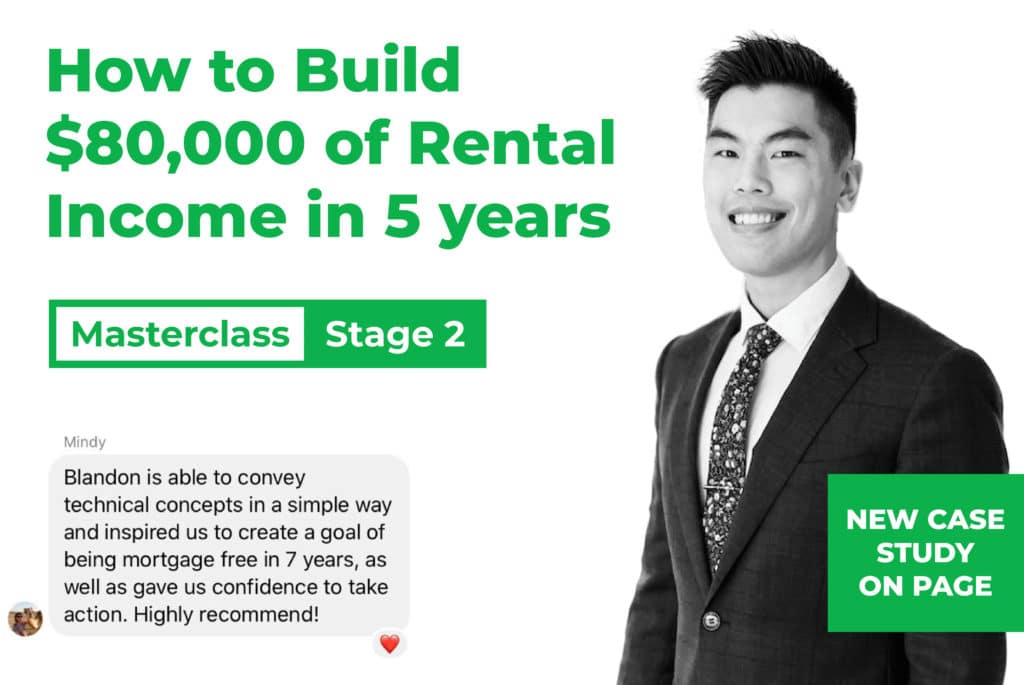

$80,000 of Rental Income

Learn How to Build $80,000 of Rental Income in 5 Years, with our Stage 2 Masterclass. Results vary and you should have $100,000 of usable equity before entering stage 2.

- Mortgage Calculators

Over 20,000 kiwis have used this tool! It can tell you your borrowing power and what options you have to save money on your mortgage. More in depth results are also emailed to you with explanations.

Compare major banks borrowing power calculators – there is nearly a $500,000 difference between results. Learn the math behind mortgage calculations and what factors have the largest impact.

Calculate your mortgage repayments for principal and interest lending or interest only lending.

See how long it will take you to get mortgage free, this calculator includes the ability to add lump sum repayments at regular intervals.

Discover all your mortgage options online with our advanced borrowing power calculator. Results include your borrowing power, restructure savings and more. Make informed plans and get mortgage free.

- Work With Us