NZ Mortgage Rates

Todays Mortgage Rates in New Zealand

Here are carded mortgage rates for a selection of nz banks and non-bank lenders. Please note care is taken to bring you the latest advertised rates but rates change frequently – so we can’t guarantee accuracy.

You will see mortgage rates from ASB, ANZ, BNZ, Kiwibank, Westpac, TSB, SBS, along with other less preeminent lenders. If one bank is much lower than the other across the board, it usually triggers other banks to follow.

You are welcome to get in touch to see what mortgage rates we are negotiating for our clients who are in a similar position to you. With thousands of clients working with us, we can nearly guarantee we have helped someone in a similar situation to yours recently. We are extremely proud of the hundreds of 5-star reviews they have left us for help with their mortgages.

| Lender & Product | Variable floating Rate | Fixed Term Length | |||||

|---|---|---|---|---|---|---|---|

| 6 Months | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | ||

| ANZ Standard Mortgage Rates | 5.54% | 5.25% | 5.15% | 5.85% | 6.15% | 6.35% | 6.45% |

| ANZ Special Mortgage Rates (LVR under 80%) | - | 4.65% | 4.55% | 5.25% | 5.55% | - | - |

| ASB Mortgage Rates | 5.35% | 4.49% | 4.49% | 5.25% | 5.55% | 6.35% | 6.45% |

| BNZ Special Mortgage Rates (LVR under 80%) | - | 4.39% | 4.55% | 5.25% | 5.45% | 5.79% | 5.99% |

| BNZ Standard Mortgage Rates | 5.55% | 5.29% | 5.35% | 5.94% | 5.99% | 6.19% | 6.35% |

| Co-operative Bank Owner Occupied Mortgage Rates | 5.45% | 4.29% | 4.29% | 5.19% | 5.45% | 5.75% | 5.95% |

| Co-operative Bank Standard Mortgage Rates | 5.45% | 4.79% | 4.79% | 5.69% | 5.95% | 6.25% | 6.45% |

| Heartland Bank Residential Mortgage Rates | 4.00% | - | 3.85% | 4.70% | 4.84% | - | - |

| KiwiBank Standard Mortgage Rates | 5.00% | 4.80% | 4.55% | 5.19% | 5.39% | 5.55% | 5.79% |

| KiwiBank Special Mortgage Rates (LVR under 80%) | - | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| SBS Residential Mortgage Rates | 185.19% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| SBS Special Mortgage Rates (LVR under 80%) | - | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| TSB Standard Mortgage Rates | 185.70% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| TSB Special Mortgage Rates (LVR under 80%) | 184.90% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Westpac Standard Mortgage Rates | 185.49% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Westpac Special Mortgage Rates (LVR under 80%) | - | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Bluestone Prime Mortgage Rates | 5.29% | 0.00% | 0.00% | 7.49% | 7.59% | 0.00% | 0.00% |

| Resimac Mortgage Rates (LVR under 70%) | 4.59% | 0.00% | 5.60% | 6.16% | 6.29% | 6.31% | 6.33% |

| Resimac Mortgage Rates (LVR under 80%) | 5.59% | 0.00% | 6.60% | 7.16% | 7.29% | 7.31% | 7.33% |

| Avanti Near Prime Mortgage Rates | 5.45% | - | - | - | - | - | - |

We’ve made every effort to make sure the interest rate information is accurate. We don’t accept any responsibility or liability whatsoever for any action taken as a result of the information on this website or for any error, flaw or omission in the information provided.

We advise visitors to consult with a mortgage adviser or their bank before making any decisions.

If you see or hear about interest rates on billboards or the TV and radio, just relax because they’re often not the rates you will qualify for. Headline rates are often specials that not everyone can get. Sometimes you may even be able to get better than what is advertised. Just treat rates you see advertised as an indication of what you might get.

Mortgage Rates in New Zealand

Mortgage rates in NZ get a lot of press because interest rates hugely impact the cost of borrowing and change frequently. Most people love to compare mortgage rates between banks and talk with experts about their mortgage rates forecast.

There are main bank mortgage rates and there are non-bank (specialist mortgage lenders) rates. Generally speaking, main banks will have the lowest home loan carded rates as they compete for 80% plus of the market share between less than 10 banks. Our mortgage brokers have access to over 28 lenders to choose between for your application.

If you are selling your house and your fixed terms still have some time to run, you may face a penalty in the form of break fees, sometimes called early repayment costs. Mortgage break fees and cash back incentives should be taken into consideration when comparing mortgage rates. Therefore often the best time to refinance your mortgage is as fixed terms or cash back periods expire.

To get an online look at what mortgage options are available for you, including potential savings on mortgage rates, check out our advanced mortgage calculator.

Mortgage brokers don’t mark up mortgage rates

As mortgage advisers, we don’t set or mark up the interest rates we secure for you – they are set by the banks and other lenders. We sit on your side of the table and negotiate on your behalf with the banks. Our service is free for most clients.

There tends to be a big focus for home owners and especially investors on their interest rates but this may be to their own detriment as this moves their attention away from mortgage product choice and structure options. The impact of tax and ownership structures and using the appropriate revolving credit or offset products, along with smarter property decisions, will in most cases impact your wealth building far more than a few little rate discounts.

Working in conjunction with lower interest rates when you are negotiating your own deal, is a cashback offer sometimes given by the bank as an incentive to take out the loan with them. You may need to spreadsheet out your offers to compare what is best for you. Try the mortgage snapshot to begin that process and just email back your results requesting a spreadsheet from our team.

Prefer to watch? NZ Mortgage Rates Explained on Youtube.

To keep up to date with mortgage news and property investing strategies subscribe to our youtube channel here.

Historic Data for Mortgage Rates in New Zealand

If you want comprehensive insights into the history of mortgage rates in NZ that link to the RBNZ website is very useful. You can download spreadsheets and view charts and graphs for different time periods and factors

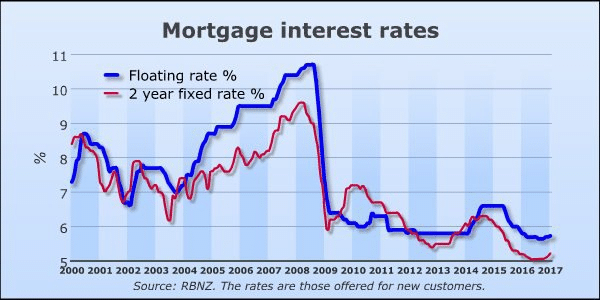

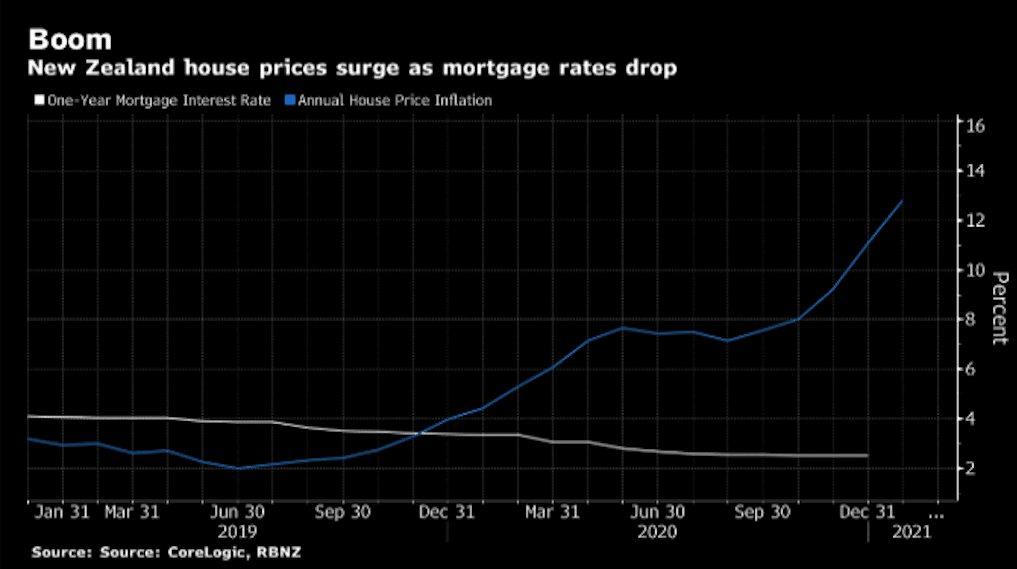

You will see the last 10 years have seen rates fall dramatically and that we have enjoyed a sustained period of relatively low-interest rates. This has led to the cost of borrowing dropping and contributed to rising property prices.

It used to cost over $50,000/yr to borrow $1mn but recently that cost has dropped to less than half of that. Existing homeowners have enjoyed a period of unpredicted but warmly welcomed, low-cost homeownership. Since 2015 there has been a steady decline in interest rates, much to the surprise of market commentators at the time, but as the economic cycle swings, it appears that rates are trending upwards. It is important to note that predicting interest rates in the long term is impossible (and a bit silly).

Which bank has the best mortgage interest rate for you?

This actually changes on a daily basis, banks use rates to control their supply and demand. When they are looking for new business, they will be more aggressive with rates. Mortgage brokers like mortgagehq can see who is offering the best rates because we negotiate rates every day.

Hundreds of millions of mortgages annually are settled by our team so we can see where the best deals are. Using the mortgagehq tools is fast and free… you have nothing to lose. No credit checks, no fees, no time in line at the bank or on hold (even we have to wait on hold with the banks).

If you have access to the lowest rates on offer and maximise the cash contributions from banks, you’ll save 10s of thousands of dollars over the life of your mortgages and will be in a far better position when you try to buy your next property (if that is one of your goals). We are selective about who we bring on as clients to help because we prefer working with people who value the extra work we put in and value the impact quality advice will produce over the long term.

The best question to ask is ‘would free mortgage advice and lower rates help me save a boatload of money and time?’. The answer is ‘yes!’.

What are special mortgage rates?

Sometimes banks will run special promotions or have specific products that make lower rates available if you meet certain criteria. You may also have worked somewhere where ‘special’ rates or discounts are offered for employees.

Generally speaking, these specials are fairly universal and can be obtained through a broker regardless of where you work or what your job is. If one bank has a special relationship with your work or through the government, you can usually get just as good deals (if not better) by shopping around a bit. It is common to see articles posted about all the like this NZ Herald one – mortgage rate competition between banks – this publicity makes it easy to get lost rate chasing.

It’s less obvious which banks have the products and offer for you. You may get an extra $200,000 borrowing power using a bank that has a slightly higher interest rate. You may be able to use a specific offset product at a discount that ends up helping you shave 3yrs off your mortgage and \$50,000 in interest expense over the life of your mortgage, but the rate is marginally higher for 12 months.

A note on mortgage cashback offers

When banks offer bigger discounts but with smaller cashback offers, you should do the maths as often the deals with higher rates are actually better because cash incentives make your net position better.

What are Low Equity Premium and Low Equity Margin rates?

Low Equity Premium (referred to as LEP) and Low Equity Margin (referred to as LEM) rates act as a form of penalty for not having the 20% deposit required to qualify for the ‘special’, best or carded rates. If you buy a home with less than 20% deposit, most banks will charge an upfront fee and/or apply a higher interest rate to offset their own risk of loaning you money with less equity in the deal. You will probably want to refinance or restructure your lending once you hit 80% or lower loan-to-value ratio (LVR).

If you are on a LEM or LEP you should make a plan with your mortgage broker to work towards getting this removed. As most clients that have these charges added do not often get good incentive cash offers when they sign up, the option of refinancing for a much better deal comes around quickly in a growing market.

What special interest rates are there for first home buyers?

First home buyers do not really qualify for any ‘specials’ unless they buy new build properties at banks that offer cheaper rates. If you are looking to buy your first home you will want to check what grants you qualify for (if any) and get feedback from a mortgage broker about what bank is giving the best LEM/LEP deals if you do not have the 20% deposit yet. You may want to consider changing banks in advance of buying a property to be with the ‘right’ bank for you.

Four Influential Factors Over Mortgage Rate Forecasts

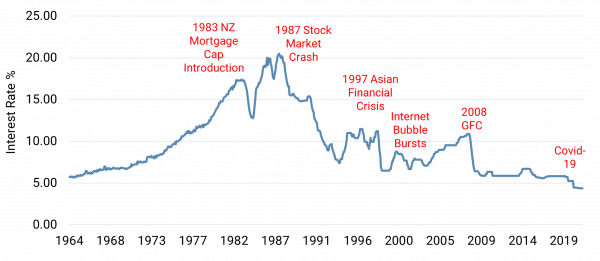

Forecasting future mortgage rates is a national hobby of economists and backyard bbq guests across the country. Here is a quick rundown of four factors that affect future mortgage rates. The theory is if you can understand what will happen or is happening to these four things you can predict future mortgage rates.

- What is happening globally? NZ is a small place most often taking what comes instead of being able to create its own pathway

- Are the forecasts coming from places where people are paid for their opinions and having no opinion would make their job hard to justify?

- What is the 20 year average? If rates go back to the ‘average’ they have been over an extended period of time, would they go up or down? Are any significant changes happening in the economy to push rates back to the average?

- What is everyone saying WILL happen? Often the opposite happens.

Unfortunately, most forecasts are wrong most of the time…

With the benefit of hindsight we can look back at history and see inflection points. It’s not easy to do this at the moment.

Using Interest Only Loans

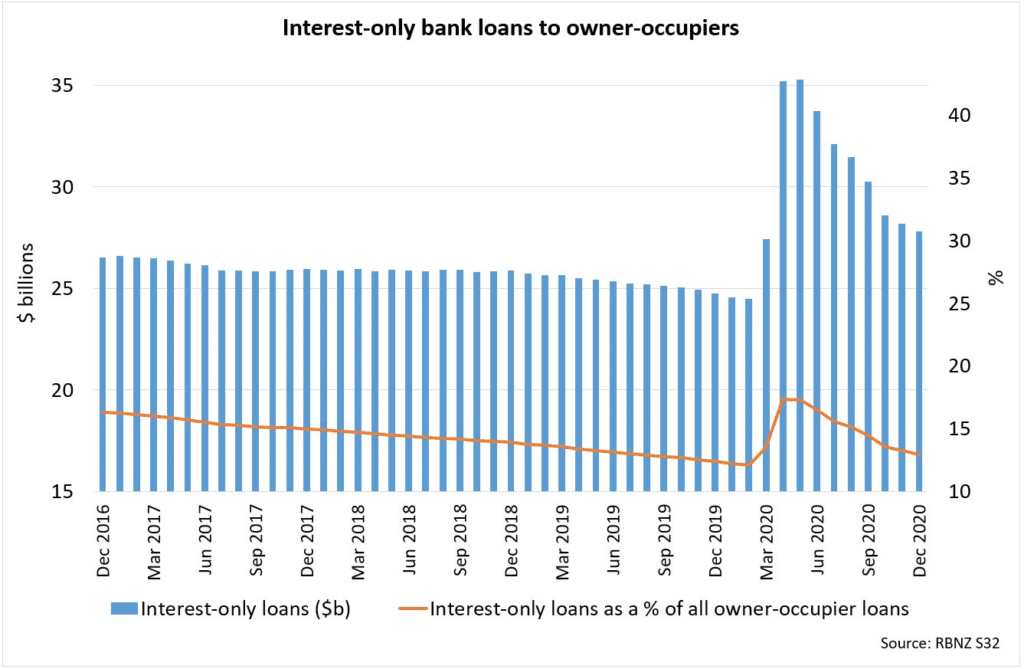

By way of illustration, I wanted to show you how the global pandemic impacted the NZ property market, especially how it changed the situation for owner-occupied properties. In NZ it is not a typical situation that the bank would allow you to use interest-only loans for your family home.

When the lockdowns began and there was a lot of uncertainty about income and the economic climate, interest deferrals came into play. The amount of interest-only lending spiked. This meant people were only paying their mortgage interest costs and not paying down any principal amounts. This helped minimise people’s expenses.

This was government initiated and somewhat forced onto the banks. You can see how regulation and political influence can quickly influence the mortgage rates and radically impact forecasts (call this a black swan because no one would have predicted that big of change so quickly).

Although a floating mortgage rate is normally higher - here are three situations where it can make sense to use one.

If you are selling your property in the next 6 months, it may make sense to choose a floating rate. However, taking into account the interest rates environment, it is probably worth fixing for 12 months in many cases especially if you think the settlement period will be long or the property marketing will take a few months to gain the price you want. Any break fee you face at the time of settlement (releasing your ownership to another party) will be smaller than the higher cost of floating rates compared with the 12-month rate.

If you are regularly coming into lump sums of money and have the desire to pay down your mortgage(s) quickly, then maintaining a large portion on floating may make sense. However, it would often be best to limit the floating portion to the amount you will likely pay down in the next 6-12 months (if any longer then fixing is worth your consideration).

If you believe you will be refinancing or restructuring your mortgages and/or properties in the near future, staying on a floating rate until that is completed makes sense to help reduce break fees and give yourselves more negotiating power.

Choose the right fixed-term mortgage rate for your situation

When you are comparing mortgage interest rates you need to take into account your overall cost. We have a separate article discussing how to compare mortgage offers. The main point is to incorporate every facet of your mortgage: interest rate, cashback offers, structure, lending power and mortgage products. Don’t fixate on the interest rate and shoot yourself in the foot.

Should you take the lowest 1, 2, 3, 4, or 5-year mortgage rates?

If you want to try and time the market for interest rates, you will have your heart set on a mortgage rate term that fixes most of your mortgage for a set period. What you may want to remember is most economists and market predictors are often (regularly) wrong. Timing the market is extremely difficult to do and if you really want to have a laugh, go back and read the predictions from leading economists from 2-5 years ago.

Interest rate averaging helps you reduce exposure to fluctuating rates and gives you options more regularly. You may end up paying an extra few dollars a week more in the long run but you reduce volatility and give yourself a better night’s sleep. If you fixed now for 3years and rates were 8% after that period, then your whole mortgage would be going from a cost basis of around 3% to 8%. But if you fix your mortgage in portions across 1year, 2year, 3year, then you are only exposing yourself to proportional cost increases. You can learn more about interest rate averaging from our videos and other pages.

NZ Interest Rates

Looking at the below chart you can start to make inferences about how interest rates in NZ may influence property prices in New Zealand. I think it is fair to say interest rates do have some impact on property prices but it’s hard to fully attribute just how much impact. The mortgage rate you pay directly affects your cash flow on property ownership and investment which in most rational markets is going to influence prices that are often based on yields.

What should you do?

Brokers (we prefer to be called Mortgage Advisers) often get discounted rates and help many clients refix their mortgages without changing banks to get a better deal. If you are not happy with those options and want to see options at other banks then we can talk about what bank would work best for your situation. The important thing is NOT to get distracted by rates and focus more deeply on your mortgage products, structure, and the game plan for achieving your property and investment goals.

Get free professional help deciding what to do next. Book a friendly zero obligation call with a team member here. This is a 10-minute chat, from here you can ask for a free borrowing summary, and get matched with an adviser specialised in your situation.

If you let your negotiation for interest rates dominate your mortgage mind, you lose the forest for the trees. The money in property investing is in the buying, selling, renovating, developing or property. Of course, your mortgage rates are an important factor but not the most important one like it is often treated.

If you get a 0.1% discount on your mortgage rate you may save $10/week. What you may not realise is if you have the wrong ownership structure that could be costing you $20/week and if you do not take advantage of the right mortgage structure you may add unnecessary years to your mortgage repayment obligations.

What is not widely known is that servicing calculations at some banks will allow for better or worse rates depending on your profile and goals so it is important to know what bank to ask for an offer and how to present your goals to them… LVR impacts your rates offer sometimes so it’s important to weigh up the pros and cons of separating securities and split banking versus getting the best deal you can.