If you’re looking to potentially save thousands of dollars that would otherwise just go to the bank’s back pocket, then you best get yourself educated on the ins and outs of mortgage refinancing.

This is a way for you to take control of your finances. Let’s not beat around the bush. We are here to wise you up on:

- what happens when you refinance your mortgage,

- how to refinance a home loan,

- when you should consider refinancing a mortgage,

- the cost of mortgage refinance,

- who the best banks are for refinancing your home loan to.

So if you’re ready for some game-changing information to come your way, read on and find out everything you need to know about refinancing your mortgage.

What is a mortgage refinance?

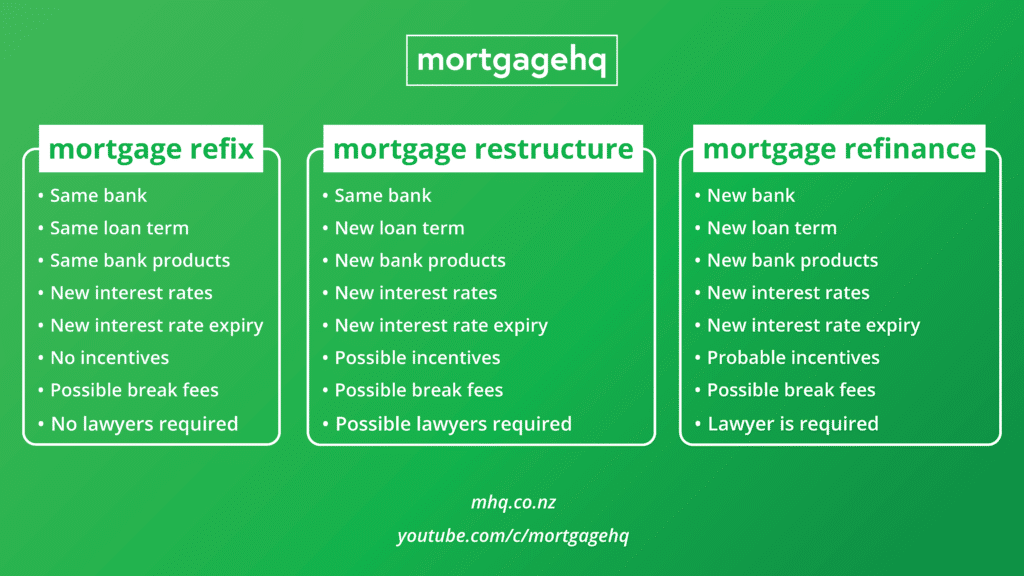

Refinancing your mortgage and restructuring your mortgage are essentially the same thing. It is when you change the terms and conditions of your loan agreement. Restructuring your mortgage is when you stay at your current bank. When you refinance your home loan, you transfer your mortgage to another bank as well (usually for good reason).

When taking this path of refinancing a mortgage loan, you are getting a whole new mortgage but that doesn’t mean you are starting again. You are breaking the terms of agreement that were initially put forth and are working out a deal that better suits you moving forward.

Break fees and other conditions will apply. Sometimes banks will waive costs when you restructure your loan and remain with the same bank. Refinancing can also lead to your new lender offering you compensation to try and win you as a customer. We advise that you have professional support to guide you through the process to ensure you get the optimal outcome from the whole market, not just from your bank. If you want the best deal, it pays to consider shopping around, but you don’t have to do the grunt work yourself.

Refixing your mortgage is slightly different. This is where you alter the fixed-interest rate terms of your existing mortgage without breaking it. You will refix your mortgage when your fixed-term rates change. If another bank offers better rates and you wish to benefit from this, then you would refinance the mortgage.

How to refinance your mortgage

Now that you understand exactly what refinancing means, you’re likely to need to know how to change a mortgage lender if a different bank offers a deal that is too good to turn down.

We have some support and guidance that is worth taking a look at to get you started.

If you want to know what’s involved in refinancing a mortgage, then we have broken down the tasks into manageable chunks.

- Do a lot of groundwork.

You need to shop around different banks for the best mortgage rates and compare them all without bias. Consider all of the potential benefits any given bank can offer you, look long term and with your goals in mind. A mortgage advisor can provide you with relevant spreadsheets that help you to visualise any benefits. We can also assist you in working out how to realise your financial goals.

- Facing the break free.

Give your current bank a call and ask them to email you all the details regarding the terms and conditions laid out in your home loan, particularly regarding prematurely ending your contract. You need to know the break fee so that you can factor this cost of refinancing your mortgage. Break fees can change daily, but get an indication and put all the details into a spreadsheet (we can provide this) so you can look at the numbers without too much distraction.

- Calculate whether you are better off

Using a mortgage calculator can help you to figure out whether it is truly beneficial for you to refinance your mortgage. Consider all mortgage refinance costs. Additional costs such as a registered valuation may be necessary as well when you move banks. Factor in reduced interest costs if you can secure them, savings from beneficial products, and any cash back incentives you will receive. Respect that mortgage interest rates do not remain the same forever. Remember saving money is only one side of the equation – the more significant half can be what will your new bank and structure allow you to do? With these, you can answer your own question of should I refinance my mortgage, or not. One example is you may have more borrowing power for an investment property or a mortgage topup if you refinance your mortgage to the right bank based on your situation.

- Speak to a mortgage broker.

This is critical because you need to have that experienced and informed support on your side to get the ball rolling at this stage in the process. If you’re looking for a seamless transaction between banks so that you can refinance a home loan easily, then get in touch with one of our team members today.

Remember that although bankers have in-depth knowledge of their own products, they do not know the offers available everywhere else. Understand that everyone working for a particular company is going to try to convince you to move or stay with them. You need impartial support at this time.

- Apply!

When you apply, you will be asked to provide basic information similar to when you applied for your initial mortgage. These include proof of income and employment to give confidence that you are able to afford the repayments on your new home loan.

Should I refinance my home loan?

Everybody is different. Everyone has unique circumstances that have led them to where they are today. The questions that need to be asked to help someone decide whether a mortgage refinance is the right choice, however, are somewhat universal.

Do the benefits outweigh the costs?

Benefits may mean something different to everyone. It may be that a home loan refinance allows a first home owner to invest in their second property sooner. Parents might be looking to help their children into their first home. The timing is right and mortgage rates have dropped.

Here are some of the common reasons why someone might consider refinancing a mortgage:

- To access better interest rates

- For suitable bank products, cash back or other incentives

- To access better home loan top up opportunities

- To recycle equity and start investing in property

- As to avoid cross security. Split banking is popular with investors

- To qualify for interest only lending if your existing bank will not offer this

- To lower your repayments and consolidate your other debts

- To pay your mortgage off much sooner through the smart use of specific mortgage products

- To change the loan term to suit your current life stage (shorter or longer) which impacts your cash flow

There are many situations when a home loan refinance allows you to save thousands. When jumped for at the right time, a low-interest mortgage refinance can help you to achieve financial freedom faster than you thought possible.

By getting creative about your approach to your future, you can find a bank that offers the best way to refinance a home mortgage. With the best available offers on the market and more freedom to invest or sell for cash to play with, making banks work for you is your ticket to success.

How much does it cost to refinance a mortgage?

Now this is sounding all too good to be true. Yea, you guessed it, it is.

When you break the contract signed with your previous lender to refinance, you’re lumped with costs. When you move to a new bank, although some refinance fees may be waived as an incentive to join, you’re usually hounded to cough up more refinance mortgage fees.

Additional refinance costs include the need for a new registered valuation, builders reports and so forth.

The cost to refinance a mortgage isn’t the same for everyone. A few standard prices, such as $1000 for a Registered Property Valuation is understood, but if you are looking to hone in on the expected costs you may be facing, then talk to all banks in question and present these figures to your mortgage advisor so that they can help you to put a figure on it.

Timing can have a huge impact on cost and understanding when your fixed-term ends or when your cashback period has expired can help you save when you refinance your home loan NZ.

When to refinance a mortgage

As just mentioned, timing can play a crucial role in the outcome of the cost of refinancing a home loan. Waiting for certain mortgage refinance offers to become available, to suit a particular situation that you’re in, is useful. As you can follow opportunities to refinance mortgages online, there is little chance of missing out on certain opportunities that could interest you.

When comparing mortgage offers, you need to remain aware of cashback incentives that you may have initially accepted and their terms.

For example, in 2018, ANZ offered a $3000 cashback incentive for new customers. That included those who were first time property owners or those purchasing investment properties. Banks have conditions that you must remain a customer with them for a certain number of years – each bank varies, if you refinance your mortgage or pay off your mortgage you will have to repay this offer.

You can use potential cashback offers to your advantage, when timing the move to another bank just right.

If you are nearing the end of your fixed-term, you may be inclined to wait it out in order to avoid break fees. Break fees reduce in cost the closer you are towards the end of a contract.

Best banks for refinancing mortgages.

Every bank here in New Zealand is unique. They target audiences at different stages of their lives. This means that bank products, special deals, lending policies, interest rates and internal calculations are never going to be the same between companies.

If you’re wanting to know what the best bank for refinancing mortgages is, you need to ask what the best bank is for you.

Understand what you want from a bank. Do you want the convenience of being able to refinance a mortgage online? Perhaps you feel better talking with someone face to face.

Where are you in your stage of life? Ask yourself:

- Am I refinancing my mortgage to avoid cross security and free up cash in my retirement?

- Or should I refinance my mortgage to recycle equity and start my property investment portfolio

Be aware that banks are constantly changing and that your circumstances are also fluid. Reevaluation is important every so often to ensure that the best bank for refinancing mortgages a few years ago remains the best bank for you at your current stage in life.

Here are a few additional FAQs that may have crossed your mind:

How much equity do I need to refinance?

The generic answer to this is 20%. As always, this can depend on the loan and the lender. Your experienced mortgage advisor can help you to find the best bank to refinance your mortgage, taking into account your bespoke situation.

Why would I consider refinancing my mortgage?

Because you are looking to improve your situation. It may be that you want to take thousands of dollars off your home loan with a low interest mortgage refinance. It could be that you are seeking more security with a fixed interest mortgage refinance.

Your reasons are your own. It may be advisable that you talk through your short and long term financial goals with a mortgage advisor to ensure that refinancing a mortgage is the right path for you.

Can I just refinance my existing mortgage without changing banks?

Yes you can. This is called restructuring or refixing your mortgage. A restructure is when you agree to a completely new mortgage contract whilst remaining with the same bank. Restructuring mortgage deals with new repayment options that are better suited to your current situation.

Refixing a mortgage occurs when you agree to not change the conditions of the mortgage, but rather renew fixed term rates, for example.

How long does it take to refinance my mortgage?

Because appraisals, valuations, legal matters and other third-party delays interfere with the process, the time to refinance a mortgage does take somewhere between 30 to 45 days to refinance a mortgage. This is after all the initial research and consideration that you have put into the change.

Do I need to shift all my banking to my home loan lender?

No. You do not need to stay with a single bank for all of your transactions. In fact, it may be beneficial to avoid doing this.

Of course, if you find it easier to manage all of your banking needs in one place, you are free to work with a single bank, but just because you have refinanced your mortgage with another bank does not mean you need to shift all of your banking to that provider as well.

You should refinance your mortgage if there is a better bank and mortgage structure out in the market to help you save money and achieve your goals.

If you are considering refinancing a home loan yet your questions have yet to be resolved within this article, then hit us up for a bespoke chat. We will ask questions about your financial situation and goals to see whether we can point you to the best bank for your mortgage.

As bank offers are constantly changing, you need to have someone on your side who has a broad understanding of home loan refinance procedures. Although bankers have in-depth knowledge about their own policies, they are unable to advise you whether another bank can potentially save you thousands.

Through confident and creative approaches to finances, we have developed ways that allow you to be in control of your money, rather than it controlling you.

If you would like to be financially free and make wise decisions about your mortgage, whether it be refinancing or reinvesting, join us today.