“I have a few questions Mum, Dad. I hope you can help. I really want to own my own house one day soon and I’ve been saving, like, a lot”.

“What should I do next?”

“How can I make it actually happen?”

“It seems pretty dire these days and the competition for property is just brutal. Perhaps I shouldn’t bother?”

What are you going to say during those conversations with your kids? Saving for and buying a first home is a huge rite of passage that isn’t unobtainable with the right guidance and support. You were dealt a different hand of cards that came with their own, unique issues when you purchased your first home, no doubt, so it may be a little confronting to offer advice designed for this generation and not yours.

First home buyers today are trying to overcome hurdles that take a creative approach to overcome. An approach that you might not have considered. Let the team at mortgagehq help.

For the wise parents out there, and also for those motivated and determined first-home buyers doing their own research, check out this handy advice guide that can help make those potentially difficult conversations about deposits and buying a first home that much more promising and exciting.

The steps to buying your first home NZ

Like anything that seems a little overwhelming in life, you break it down into bite sized pieces, and it is a whole lot more manageable.

So here are the chunks you need to rip off if it’s your ultimate goal to buy a first home here in NZ. Obviously, there is a bit more to buying a house in NZ, which we do go over in depth in this article.

Talk to a mortgage advisor to avoid regrettable mistakes

This is free of charge and could be the most valuable 45 minutes you can get as you prepare to buy a first home. First home buying tips are dished out and realistic conversations are had so that you can budget effectively. It may be that you go away and come back in 6 or 12 months after following our advice to ensure that you’ve got the best chance of success.

A mortgage advisor will give you a comprehensive review right on the spot highlighting the benefits from different banks. Only such professionals have such broad knowledge. It would take a lot of time and energy to approach different banks and non-bank lenders and work out the differences between each one, understanding what would suit you best. A good adviser will help you understand the difference between becoming a guarantor for your children, buying as a partnership, and using a gift to support their deposit. There are so many nuances with each of these options and you simply won’t get the same level of detailed answers without a good mortgage adviser helping you.

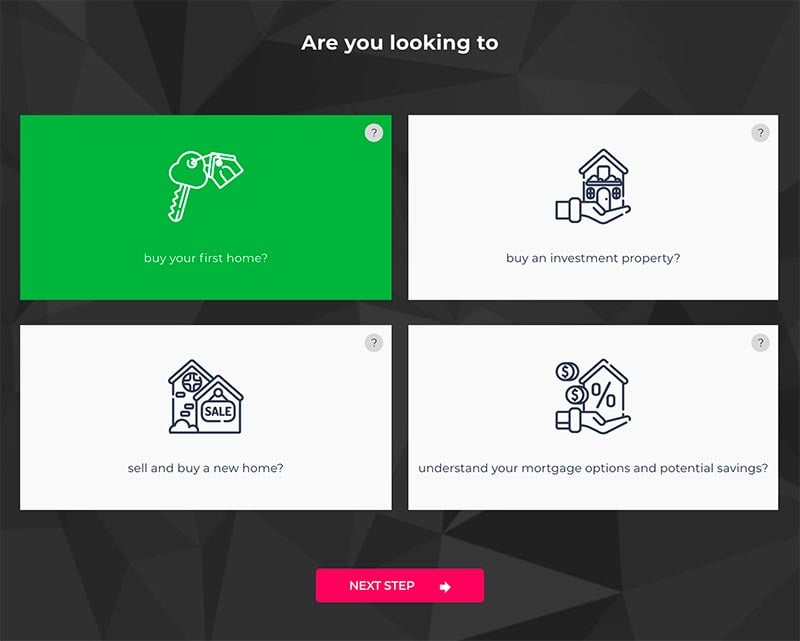

Get pre-approval

Your next step is to approach a bank to see whether you qualify for pre-approval. This is a figure that the bank agrees to lend to you, given that your financial circumstances or their conditions do not change. It is valid for 90 days. You do not want a scatter gun approach here because it’s a waste of time and a big hit to your credit score if you apply at all banks. You want to understand from someone in the know what banks are going to be best for you based on your specific situation and the bank policy at the time. The old school method of calling up your banker mate might be the worst thing because they might lead you down the wrong pathway.

You can get a rough idea of how much you could borrow by using different mortgage calculators first. But be aware that banks will lean towards the conservative side and consider your ability to service a loan with much higher interest rates for their added security.

Mitigate risk

Reaching that 20% deposit is difficult and although there are options available that allow you to enter into a mortgage with a lower deposit. We go into this in-depth, here, in this article.

For wise parents who are able and looking to help their kids as best they can, helping them to reach that 20% deposit threshold could save them thousands in additional fees and interest rates. We will go into this more soon. If you can’t help with getting your kids to 20% do not stress, it’s not a must.

Setting up your loan

Finding the best way to set up your mortgage is a different journey for everyone. A great mortgage advisor is someone who really understands not only what is available out there, but also what home loan structure is going to best suit your usual spending habits and your personality.

Although the technical process doesn’t alter whether you are buying your first home or your 10th, there are a few differences in the approach that we will focus more on here to make sure that first home buyers are doing what they can to find success.

The first home buyer deposit guide

Don’t forget that first home buyers can benefit from a few incentives available that can reduce the amount of cash you need to fork out as a deposit.

- You can draw out all but $1,000 of your KiwiSaver to help towards a deposit for a first home.

- The First Home Partner

- and the First Home Grant are both incentives to help first home buyers onto the property ladder through Kāinga Ora.

But do you still need to hand over the grand sum of 20% of the total purchase price to a bank in order to secure lending? This is unless you buy a property that is exempt or get an approval that allows for less than 20% deposit.

Although restrictions are tight due to CCCFA law changes which makes it more difficult for new borrowers, this won’t last forever. All banks’ procedures are standard but frequently changing. This helps first time home buyers to prepare for the possibility of acceptance. Continue to budget accordingly to be ready at a moment’s notice to apply for your first home loan.

How much you need for a deposit as a first home buyer in NZ can be as little as 5%, with support through the aforementioned Kāinga Ora schemes.

More common is the absolute minimum 10% deposit, however the criteria to be accepted for these riskier high LVR (loan-to-value ratio) loans are harder to meet. For example, you need to have a pretty high income in order to show that you can service the loan, be squeaky clean without any short-term debt and there are also additional fees to encounter.

The difference between a 10% and a 20% deposit (for education sake)

A major disadvantage for buyers with less than 20% deposit is that banks will generally require you get a valuation done on a property before they give the green light for you to go unconditional. This is ok during a negotiation agreement but for auctioned properties, it can be time consuming and expensive. You basically get locked out of auctions as a purchase method if you have less than 20% deposit unless you take the big risk of going unconditional at auction without bank approval (and hoping they agree to finance it).

Making the push to get over that 20% line will benefit you hugely in the long run. For higher LVR lending, borrowers are charged low equity premiums. These premiums and additional fees can rack up into the thousands so if you can avoid them, you’re going to be better off.

If you are on a higher interest rate due to securing a high LVR home loan, once you pay your mortgage down and reach 20% equity, depending on the bank, you may be able to automatically switch to a lower interest rate and have that low equity premium removed. A good bank can even give you cash back.

Other banks may make you wait out the fixed term, but the break fee could be worth it for what you will save. Everybody is on a different journey and each step of the way is meticulously calculated for you by a mortgage advisor to make it that much more seamless and stress-free for you.

How can parents help these first home buyers?

One such way that parents can help their kids to get into their first home is to either:

Gift them the money.

Parents or others in a position to do so can ‘gift’ first home buyers a sum of money to make up their initial deposit. The money can be returned in some way as is your personal agreement but keep in mind this is against the agreement terms you declare to the bank as the gift must be declared as such. The equity in an existing property can be used and a home loan restructured or savings can be given.

Be a guarantor.

This is not as common as it is a bit complicated and can have some drawbacks for both parties, especially if there are other siblings to consider. It is slightly messy with the cross securitization of assets and if any party wants to borrow again in the future, then it needs to be disclosed.

If this is the only available option to you, then make sure that you use a mortgage advisor to explain the advantages and disadvantages as a bank will always look out for their own interests first and may neglect to enlighten you to certain aspects of this path.

Don’t forget about the long-term

Servicing a loan is where most investors come unstuck, so make sure that you understand your mortgage requirements and are confident that you have the income and budgeting capabilities to continue to pay off your monthly repayments.

There are plenty of free mortgage calculators available and the one designed by mortgagehq is a brilliant tool that gives you the knowledge and confidence that you need to make sure you are in a healthy financial position as a first home buyer.

Think (and live) outside the box.

Purchasing your first home isn’t only about saving for a deposit. Finding the perfect property has a lot to do with being in the right place at the right time. All of those who find success however, whether it takes them 2 months or 2 years, are committed and ready to make a decision when an opportunity crosses their path.

Increase the chances of finding yourself in a good position by following these unconventional first home buyer tips:

Find undesirable properties.

This is especially true in major cities. Don’t compete with developers who have deep pockets so avoid homes that have developmental potential in the short and long term as they are going to attract more interest.

Look at the zoning. A flood zone or a single storey zone will attract less interest. A narrow driveway also may mean that the price becomes more reasonable with less competition in your way.

Recently renovated properties are also less interesting to developers looking to make income on renovating themselves.

Keep it small.

Developers will be looking for 600sqm or larger sections, where they can put multiple properties. Capital value increases with land size, so keep it small if you’re looking to get onto the property ladder a little easier.

Consider cross-leases or apartments

A lot of people avoid these as do developers, so you may have an advantage over others. We generally don’t advise our clients to buy apartments due to the lack of capital gain, but for a first home buyer who has become frustrated with their options, it may work. Dual key apartments can mitigate costs by allowing you to rent out the other half to generate income. Remember, this is the first rung of a ladder.

Low yield areas

Spot what scares others and see if you can live with it. Areas that do not have a high rental yield for whatever reason will not be appealing to investors and therefore leaves the door open for you and other first-home buyers to come in.

Auctions

Get pre-approval as a first home buyer and don’t be afraid to act quickly. Offer a great price and bring the auction date forward with an unconditional pre-auction offer. The less time it is on the market, the less exposure and attention the property will receive, effectively reducing the potential competition.

Who are your friends?

When you’re juggling all of these things as you search for that first home,it can get a little overwhelming. Thankfully, throughout the process, you create a team of professionals who you can come to rely on, knowing that they are on your side.

Your mortgage advisor.

Your mortgage advisor loves watching their clients progress through their home buying journey and helping them in very bespoke ways. Over the time that they spend with their clients, they generally become good friends.

A mortgage snapshot is one way that mortgage advisors can quickly get their clients on track and let them know what they need to do to align home ownership dreams to reality as quickly as possible.

A good solicitor

They are going to make your life a whole lot easier and potentially save you a ton of money by adding clauses to agreements to protect you and ensuring that the contracts you sign are fair. You need to understand what you’re signing and your lawyer can cut through the jargon to make sure you do.

Buyers agents

Specifically for Aucklanders, a buyer’s agent is going to save you a lot of time and give you that edge over others in such a highly competitive market. Let them know what it is you’re after and they can let you know as soon as something becomes available so that you can act quickly.

Who is the well funded competition?

Developers and investors are really competitor #1. They often have deep pockets and the ability to borrow with 0% cash deposit. You’re on the back foot from the beginning, so your best bet is to avoid where they are looking as a first home buyer.

Other first home buyers are your next competition although the playing field is somewhat more equal. Putting yourself in the right place at the right time is key here to success.

A response guide to all those first home buyer FAQs

A quick Q&A that parents might find themselves in when chatting with their kids who are looking to buy their first home.

Remember that every first home buyer’s journey is different and a mortgage advisor can help them to create a path that is going to work for them.

Q: Should I buy the most expensive property that I can afford?

A: Usually no. Use your pre-approval amount as a guide. The lower the overall price of a property, the higher your deposit will be and the quicker you will pay off your home loan.

Q: What if I overpay for a property? What if I buy a lemon?

A: Especially if you have a high LVR, a bank is going to ask you for a Registered Valuation. This valuation will be current and will let you know whether you are potentially overpaying for a property because this scenario would not be advantageous for you or the bank.

Q: What type of loan should I get? How long should I get it for?

A: A mortgage advisor can help you understand what type of loan is going to be best for your financial situation. They will also talk you through the risks and benefits of fixed rates for 1-5 years or floating rates. You can even create a mortgage that is a mixture of many types.

Q: Can you be my guarantor?

A: There are a few reasons why being a guarantor isn’t the best idea, however let’s discuss whether we can help you to top your deposit up. It will save you from handing over $1000s unnecessarily to the bank with those low deposit premiums.

Q: Should I get an apartment?

A: It’s not a silly idea to consider properties that suit you and your needs right now and they aren’t very attractive to investors or developers, so absolutely! Let’s go check some out.