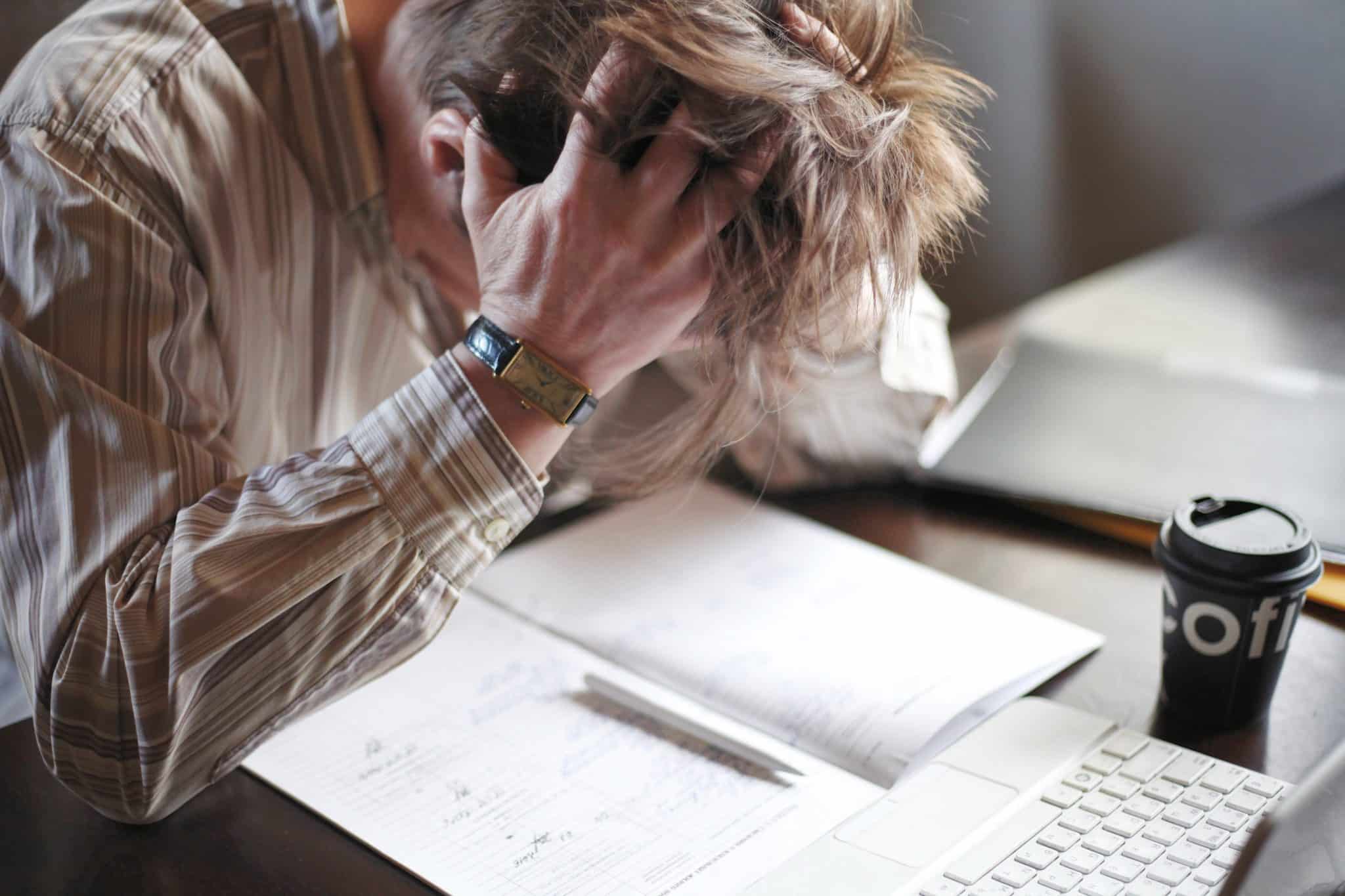

It’s stressful when your mortgage application gets declined. Sometimes the bigger reason why you’re stressed isn’t that it’s declined, it may be because you don’t know what next steps to take to get your mortgage application approved.

Here are 3 common mistakes people make when applying for a mortgage (and how to avoid them):

- Non-disclosure

- Wrong bank – Income that sits outside of their policies

- Security – The property itself

Non-disclosure

This is one of the biggest reasons why mortgage applications get delayed or declined. You need to disclose as much as possible about your financial position. There are 4 key areas: assets, liabilities, income, and expenses. Although this rarely happens a few people have actually gotten their approval taken away by the banks because they failed to tell them that they were pregnant at the time of application, and they went on maternity leave just before the settlement happened.

How do you avoid this mistake?

Invest more time upfront to get your information correct.

Two areas that you need to take extra care of are your liabilities and expenses.

Liabilities: These are personal loans, ‘buy now pay later’, mortgages, and credit cards. These will all contribute to your application and how likely it is for you to get approved. It is important to get your limits, interest rates, and terms correct.

Expenses: Anything that is going out regularly should be disclosed. These include insurance, childcare expenses, subscriptions, donations & tithings, and investments & savings. These all impact your borrowing capacity. If you don’t disclose these in the beginning and the bank picks them up as expenses later on, that will reduce your borrowing capacity (surprise!). But if any of those expenses are going to discontinue in the future, you should also tell the bank as this will increase your borrowing capacity.

Bonus tip: Be transparent with your mortgage adviser about your future financial position. For example, let them know if you plan on having a baby, changing jobs, or changing your hours of work. The more your adviser knows, the better they can make a judgment call on how to present your application to the bank.

The wrong bank – or using income outside their policy

Fluctuating income that isn’t consistent may be a reason why your mortgage application was declined. Commission, overtime, and bonuses are all viewed differently across the main banks. For example, one bank might take commission for 6 months but only apply 80% of their commission towards their servicing capacity. But another bank might look at 2 year average and they’ll take 100% of that income. Business income will have the biggest difference because there is a bit more grey area. The standard bank policy will want to use the average of 2-year financial statements, but there are situations where the bank will use 1 year of financial statements and in another, they might consider using a forecast. Now if you mix this in with bankers varying experiences, you can get a massive discrepancy in your end result.

How do you avoid this mistake?

Understand which bank will be best for your income position. Some banks will look at your income more favorably and you’ll be able to use more of that income towards your borrowing capacity. You can always ask the bank how they view commission income, and how much of that income will they use in the servicing calculation. Of course, this would be easier with a mortgage adviser as they will have all the banking policy guides.

The property itself

The third reason why your mortgage application was declined may be because of the property itself. Banks tend to like properties that are easily sold in the market and could be sold quickly. The 3 most common types of properties that get rejected are homes with high moisture readings, homes with unconsented work, and old houses that aren’t in a livable state.

How do you avoid this mistake?

Get relevant reports upfront and present them to the bank. These reports include builders’ reports, moisture reading reports, and builders’ recommendations on what needs to be fixed and how much it will cost. This will give the bank more confidence as well as give you a good idea on how much money you’ll need to get the house into a good state.

Too much to handle?

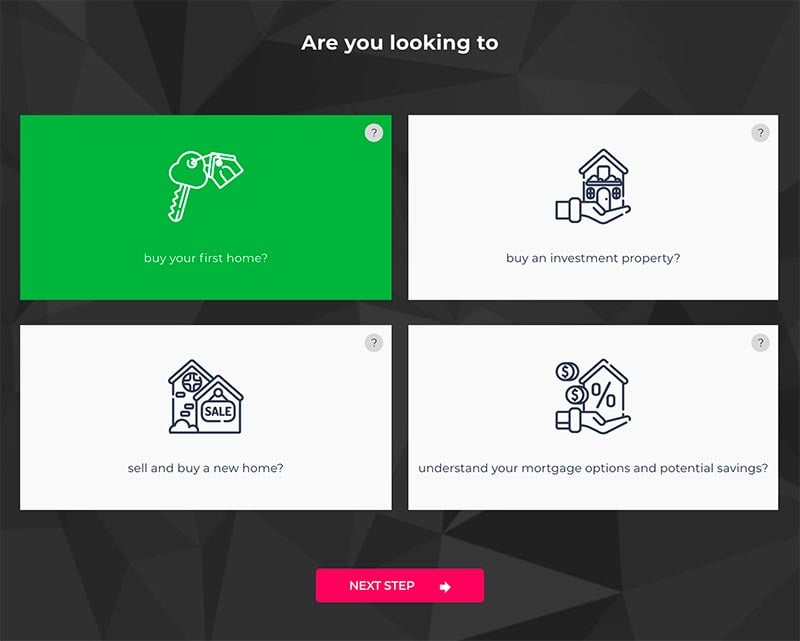

You can always get help from a mortgage adviser. They will be able to let you know which reports you may need before you spend your money, and which bank will be best suited for your financial position. Book a call today with one of our friendly mortgage advisers.