Three rules to follow when purchasing an investment property

Buy when yields are favourable:

As a contrarian investor, it’s important to follow the numbers, rather than the whims of the market. You should be taking the opportunities the market presents you, rather than following the crowd. At some point during the boom phase of an economic cycle, market irrationality will take hold, and investors will buy into the hype. Returns will begin to worsen, this is when wise investors will sit on the sideline, and wait patiently for opportunities to arise.

Buy when leverage allows for it:

Regardless of what stage you are in the economic cycle, focus on finding an ‘outlier’, that is, the opportunity no one else is willing or able to see. If an undervalued property presents itself, and it’s producing your required return, don’t shy away from the purchase because the market as a whole is showing signs of irrationality. To buy undervalue properties you need to have a solid understanding of how to properly value a property.

It’s important to recognise that property investment should be a long-term means of building wealth. Instead of focusing on the buying and selling, remember where you expect your portfolio to be in 10-years time. Often an extra purchase today will have a huge difference to the long-run performance of your portfolio. Timing the market is often difficult, and what’s more important, is looking for opportunities that align with your investment criteria, and making sure your portfolio remains well capitalised. Too much debt may make servicing difficult if rates were to rise, while an undercapitalised portfolio may be leaving potential future returns on the table.

Leave your emotions at home

When buying an investment property, it’s easy to forget it’s just that! It’s not a property you’re going to live in. It’s also not the only opportunity out there. Many first time investors will run out and buy the first property they see that smells of ‘potential’. Don’t fall into this trap. Set good rules around analysing an investment. Most importantly, do your research, and your due diligence. Don’t get sucked into your own world and forget that patience often pays.

Using Property Cycles to make money.

“While they may not know what lies ahead, investors can enhance their likelihood of success if they base their actions on a sense for where the market stands in its cycle.”

— Howard Marks

Cycles are a part of life – the moon, the tides – nobody denies they exist and work. The moon and the tide are very regular and predictable. But there are other cycles that are harder to predict but everyone still believes in them, for example, New Zealand will have approximately one magnitude 8 earthquake every 100 years (GNS Science), and we understand after the earthquake, there will be aftershocks. The earthquakes are totally unable to be predicted but undeniably follow a cycle. Within New Zealand Canterbury has a different earthquake cycle compared to Wellington or Auckland, similarly, the property cycle in New Zealand is not consistent across the country and can’t be predicted with accuracy. Homer Hoyt was the first to study property cycles, he published his dissertation 100 Years of Real Estate Values in Chicago, in 1933. Now it is common knowledge that property markets have cycles where house and land prices go through slumps, upturns, booms, slumps, downturns, busts and periods of stabilisation.

So choose carefully when you invest – some periods are better than others. If you get your timing right the rising tide will lift all boats so you don’t need to be particularly skilled in terms of your purchasing decisions to make money, however, if you are trying to make money in a stabilising, busting or down turning market you will need to be very skilled in property investing to profit.

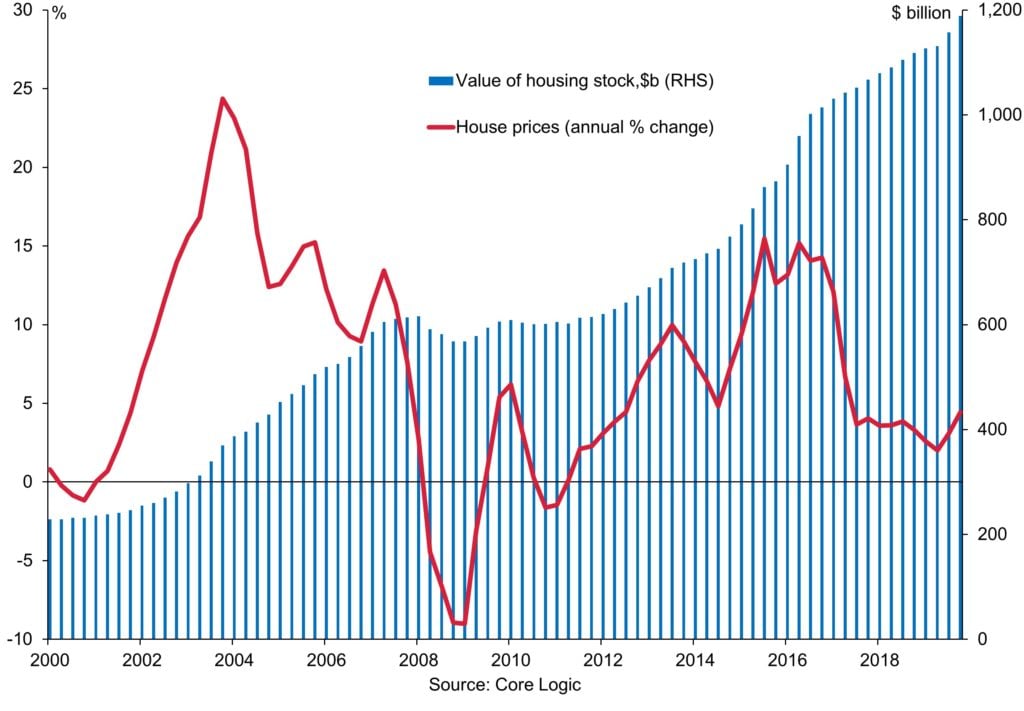

Historic values in New Zealand

House prices are not an independent phenomenon – they are connected and caused by other factors such as mortgage costs (interest rates), government policy (LVR rules), market supply and demand (population, pricing, council zoning), building costs (wages, red tape, raw material costs), popularity (all my friends are buying houses or they are all selling houses to buy bitcoin and I want to fit in). Each of these and other factors combine to drive the value change of both land and housing.

Source: Reserve Bank of New Zealand.

Here is a graph revealing New Zealand’s property cycle by showing house values over the last 25 years. It uses the RBNZ House Price Index, the HPI is a set of data developed by the Reserve Bank of NZ in collaboration with REINZ and it uses an index to represent value, we can see how long it has taken for house prices to double. You can view the RBNZ dataset here.

New Zealand House Price Data

Using the data from 1989 to 2018 there are some interesting takeaways about the possibility and length of time taken for properties to double in value:

To have your property double in value the last possible time to purchase was September 2005 when the index was 1,244 it would have taken you 13 years to double to 2,504 in March 2018.

The shortest time to double in value was purchases made in March 2002 which saw their value double by March 2007 in just 5.3 years.

Length of time for a property to double in value (New Zealand)

Average 10.1 years, 7.10% compounding per year

Minimum 5.3 years, 13.97% compounding per year

Lower Quartile 8.7 years, 8.29% compounding per year

Median 10.3 years, 6.96% compounding per year

Upper Quartile 11.8 years, 6.05% compounding per year

Maximum 14 years, 5.07% compounding per year

DATA FROM RBNZ 1989 – 2018

A Typical Property Cycle

House price cycles will generally follow a pattern that has a curve rather than prices falling off a cliff – unless there is a triggering event that was hard to predict such as the GFC. The curve has three phases which are described below.

Stabilisation

Values firm and rise slowly, check median prices.

House supply excess slowly erodes, check ‘average days to sell’, number of listings.

Yields start to increase, compare median rents vs median prices.

The general feel of the crowd is caution, hesitancy with pockets of fear that prices will go down forever.

Low-interest rates may have contributed.

The increasing economic performance or consumer and business confidence may have contributed.

Boom

Values are increasing rapidly quarter on quarter.

The number of houses for sale dwindle.

Yields start to decrease; people are buying negatively geared property.

The general feel of the crowd is fear; they are afraid they will miss out, and prices will go up forever.

Low-interest rates may have contributed.

The high economic performance or consumer and business confidence may have contributed.

Bust

Values are decreasing rapidly quarter on quarter.

The number of houses for sale explodes.

Yields start to increase but are hard to calculate because houses are selling under their advertised prices.

The general feel of the crowd is fear; they are afraid they will be forced to sell at a loss.

High-interest rates may have contributed.

The poor economic performance or consumer and business confidence may have contributed.

Is it essential for your house to increase in value?

You can see that the timing of your purchase will have a substantial effect on how long it takes for your house to increase in value, which leads us to an important question. Is it essential for your house to increase in value? At a surface level, the answer is obvious and yes. But when looking deeper, the importance is hugely dependent on what sort of investor you are.

If you are purchasing with negative gearing and interest-only loans – the only exit strategy you have is to sell at a premium. The increase in house value is the difference between riches and bankruptcy.

If you are purchasing with a low yield and interest-only loans – the only way to make a high return is by selling at a premium (because you just made a low yield while owning). The increase in house value is the difference between riches and stagnation.

If you purchased with a quality yield using principal + interest loans, you don’t need to sell at a premium to have made money. In fact, you don’t ever need to sell because your tenants are paying off your mortgage.

In Conclusion

An astute investor will look at the property cycle as a factor to utilise when making purchasing decisions, but most buy-and-hold investors will naturally follow a pattern of buying during busts or periods of stabilisation because their purchasing rules and criteria get them to purchase when yields are high. To work out your next step take the mortgage snapshot today, which will automatically calculate your purchasing ability, potential mortgage savings, or ability to top-up your mortgage.

Apartment investing

Generally speaking, people buy apartments to live in themselves or for cashflow purposes. If you work in the city and want to buy and live in a property that suits your lifestyle and potentially have your mortgage supported by flatmates, buying an apartment can be a wonderful and complete way to enjoy short commutes and all amenities close by.

However, if you are buying apartments for cash flow, you need to take into account that often the capital gains are much lower relative to properties that come with their own land and apartments actually do not always perform that well in terms of cash flow.

When you look at Auckland apartment capital growth numbers over some 10yr periods, you see an average of 3-4% capital gains annually compared with other properties of similar values increase over the same period at 11-12% each year. This means the value of the property with land (when you buy well) can double in value much much faster and you can usually rent them for about the same amount (sometimes a bit less).

If you are targeting capital gains as a wealth-building strategy (instead of, for example, flipping properties for profit) then apartments have not historically performed as well as suburban properties in the 2nd and 3rd rings of the city.

Apartments are popping up all over the place and it’s hard to tell if the quality is as good as the real estate agent is saying (only time will tell) and paying full HOT market price for an apartment with no land can be risky if the market falls at the wrong time for yourself personally taking into account your investing timeline, it might set you back 10years if the values drop by 10% because you will not be able to recycle equity and banks are quite likely to reduce the amount of lending they allow on apartments in times of property doom and gloom.

Buying apartments to renovate or apartments that a way undervalued can be a good strategy, but you really need to know what you are doing, more so that buying normal houses. SO if you can afford to, buy residential homes, not apartments unless you have strong reasons for doing so.

Be aware of broker and agents flogging off apartments as ‘spectacular low maintenance investments’ because this is usually where they make big commissions from the developer or somewhere along the line that makes money from your decision. Seek advice from multiple trusted and knowledgeable advisers.

When is buying New Build property a good idea?

If you are looking for a new home to live in, where the location is right and the price is fair, buying a new build can be a great way to lock in a beautiful new home designed to your needs and with a 10yr builder’s warranty.

When is buying a new build a bad idea? When you are buying out of an area you are familiar with, simply because the LVR rules are allowing you to buy again as an investment property with a lower deposit.

Far too many people have been tricked into buying overpriced ‘new builds’ by clever agents disguised as advisers who push the ‘cash flow’ pitch and claim that capital gains and equity growth will make their clients rich. When in reality, the builder has held onto all the margin and the agent has made a big commission selling you on the property they would never buy.

New builds can be great investments. If you want low maintenance and believe you really understand the market and fair value (so you do not overpay) then buying a new build in the right time of the property cycle has proven time and again to be a great investment. Just remember though, these properties usually come with less land to other properties of similar prices in the same area and they have very little scope for capital improvement (ie adding a bedroom or bathroom or doing some renovations to improve cash flow and equity) so you cannot build equity in them this way. You rely on the market continuing upward quickly unless you are a super patient investor.

Buying a new build on the outskirts of Hamilton or in Hawkes Bay if you are an Auckland investor is probably NOT a good idea because you will not understand the area, the builder will not give you a discount, the property could very well be vacant more than you expected which brings the yield way down… do not buy when you can, buy what you should buy when you can.

Why do many investors prefer to buy in Auckland?

All variables the same, except location, buying in Auckland instead of somewhere in the regions, will get you a better long term return on your investment. This is based on historical and future predicted outcomes. Yes this is assuming the trends will continue but looking at the numbers the capital gains in Auckland over the last 50 years has been much better than in other areas.

I will use simplified figures.

What does this mean? Buying a $1,000,000 house in Auckland and getting 6% capital gain over the next 20 years will mean your house will be worth over $2.2mn+ ($60,000 a year or more). If you buy somewhere with capital gains of 4% then your house will be worth $1.8mn+ ($40,000 a year or more). This is the average.

So why do people choose lower expected capital gains? Because of cashflow – higher rents. Let’s assume the Auckland property has weekly rental of $650/week and the regional property has $750/week. Taking 50 weeks of rent a year, this is a $5,000 difference. However, the capital gains difference is still $15,000 better off by buying in Auckland.

I stress that this is simplified for illustrative purposes. You need to choose the best investment for your own situation. Many investors do not suggest relying on capital gains, however, it is common that these same investors have had significant capital gains themselves!