LVR Rules and LVR Restrictions

LVR stands for Loan to Value Ratio and is the percentage of mortgage to the value of your property. For example, if your house was worth $1,000,000 and you had a $400,000 mortgage – your LVR would be 40%. Do not confuse it with your equity which would be the opposite, ie 60%.

Before Covid-19 the Reserve Bank was placing restrictions on banks in regards to their LVR ratios, however, the RBNZ dropped all ‘LVR speed limits’. Then they reintroduced more limits. To find up-to-date RBNZ guidelines it’s always best to see them on their official website. But be warned, what you read in the news or the headlines is not always 100% accurate with regards to your options.

https://www.rbnz.govt.nz/news/2021/02/financial-stability-strengthened-by-firmer-lvr-restrictions

You will see there is mention of some investors allowed to fall outside the restrictions. You should also know that there are many specialist mortgage lenders, sometimes referred to as ‘non-bank’ that are not restricted in their lending options by the RBNZ because they are not banks. Most of these non-bank lenders are institutional funds specifically focused on mortgage lending and nothing else which allows them to be quick and apply more commonsense to their investment decisions.

When you’re working out your LVR, you take your mortgage and divide it over the value of the property. To value your house you can use a registered valuation, council valuation, homes.co.nz estimate or get an eVal.

Say your mortgage is $650,000. Your house is valued at $950,000. So, what you do is you take your $650,000, after dividing it by $950,000, you get 68%. So, this person’s LVR on this property is 68%. Please read on to deep dive into LVR otherwise read this article to learn about all aspects of mortgages. Keep up to date with news on LVRs by reading interesting articles like this one on interest.co.nz.

Loan to Value Ratio on family homes

Now let’s say people are asking this question, “Oh, the reason I’m asking about Loan to Value Ratios is that I need to borrow more money.” So, generally speaking for an owner-occupied property, your family home, you can go up to 80% LVR. What that means is you need to keep 20% equity in the house. Often when the bank gives you a mortgage pre-approval it will be conditional on a valuation – this is so they can check what LVR you will end up with. On the topic of conditions, a condition we highly suggest you use is ‘due diligence‘ to check if the property is a good purchase.

This is so the bank is always safe if the property prices dip, they’ve always got a safe buffer if they ever have to force you into a mortgagee sale. It’s basically to protect the bank, but it’s also to protect the banking industry as a whole – if there’s a bit of a dip so that there’s not a massive rush of houses for sale, which can bring the values down even more.

How does the size of your deposit affect how much you can borrow?

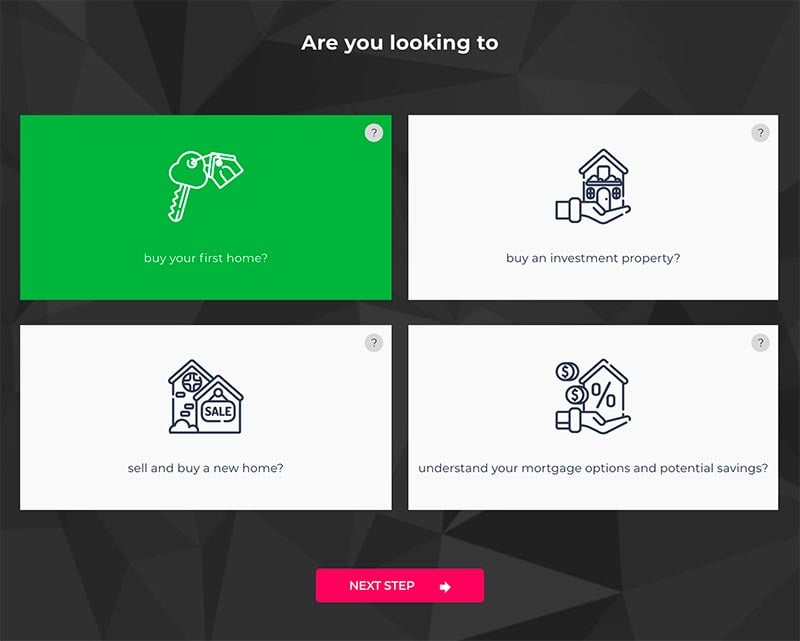

Once you have a clear indication as to how much you’re able to pull together as a deposit, it’s time to start figuring out what size mortgage you’ll be able to borrow from the bank. Loan to Value ratios (LVRs) limit what the banks are able to lend toward the purchase of a home, and work differently depending on your unique circumstances. You can use our LVR calculator to the right to see what your LVR is likely to be.

LVR Scenario 1: Contributing 20% equity or greater toward your purchase

That’s the equivalent of a $100,000 deposit to purchase a $500,000 property. There are many benefits to putting in at least a 20% deposit toward your first home. Most importantly, the banks will be able to offer you their “Special” interest rates, which are their lower advertised rates. You’ll also avoid any Low Equity Premiums, which are an extra margin added to the interest rate if you are deemed to be a higher risk borrower (one with a low deposit relative to house price).

In all cases, if you can afford to, putting in at least a 20% deposit is recommended. It’s the best way to avoid many restrictions the banks put on other purchasers, and get the best interest rates.

LVR Scenario 2: Contributing between 10% and 20% toward your purchase

Not everyone is able to contribute the full 20% toward their first home purchase. This doesn’t mean you’re out of options. In fact, there are still plenty of great ways to get a foot in the door. You’re just going to have to get a little more creative and tick a few more boxes to get things right.

The government has encouraged lenders to take on the Welcome Home Loan scheme, which works in conjunction with the Homestart Grant. If you’re eligible for one, you’ll also be eligible for the other, and only need to contribute a 10% deposit toward your purchase.

When applying with a smaller deposit, the banks charge you a “low equity margin”, or some variation of this, which is a cost to you that is charged as the lending is deemed to be higher risk.

ASB, ANZ, BNZ, Westpac, all charge this premium, but may apply it in slightly different ways. As an indication, the ANZ uses the following method for charging a “Low Equity Premium”.

If you were to purchase a $500,000 property with a 10% deposit, you’d be in line for an LEP charge of $3,375. This needs to be factored into your costs when considering a purchase.

If you’re going to be putting in less than a 20% deposit, most of the banks also require you to have relatively stronger incomes. For example, a home-buyer looking to borrow $500,000 with a 20% deposit would be required to have around $100,000 in income, while someone with a 10% deposit would need closer to $110,000.

LVR Scenario 3: Contributing Less Than 5%-10% toward the purchase of your home

While it is still possible to purchase a property with only a 5% deposit in New Zealand, it’s difficult to achieve in reality. The banks will expect you to have exceptional circumstances supporting your case. For example, you’ll need to have a great job paying you a great salary, with good prospects for salary growth. For example, an accountant, lawyer, or doctor in the early stages of their career.

You’ve heard the stories.”I built a 10 property portfolio in 17 months…” To build that fast. You need to get ‘Infinite Growth’.

To rapidly build a portfolio requires a specific lending environment.

Perhaps you’ve thought, “that was possible back then. But not now”.

During recent years – it has been extremely difficult to establish or grow property portfolios quickly.

But that wasn’t your fault.

The restricted limited lending environment has meant that most Kiwis trying to build a property portfolio have had to go much slower than they would have liked.

But the world is changing. The key numbers have changed.

When you buy your first house the two key numbers are your deposit and your borrowing power.

When you buy your first home you can sometimes get approved with as low as a 5% deposit.

However, when you buy an investment property (the 1st or the 20th) you need a bigger deposit. In the last ten years, there have been radical changes in how large a deposit was required for investments.

We witnessed a ‘boom time’ when people could buy investments with as little as a 20% deposit.

As experienced investors have already figured out, you do not need a cash deposit… you can use your equity. Based on the LVR and equity your portfolio currently has, you might be able to keep buying properties with 100% finance. Just working with a creative mortgage advisory team is going to increase your odds of finding a lender who can help you even if the bank cannot quite get you what you want.

Equity recycling (for property investors)

Equity recycling is where you have a deposit (it could be made up from cash, or available equity in your portfolio or home) and you use that deposit to buy an investment property. By increasing the value of your new investment you are able to pull the initial deposit out of the investment and recycle it into a new investment. This is the key to building big portfolios fast.

Rapid equity recycling was virtually impossible when you need a 40% deposit. To increase the value of your investment there are two key strategies;

- buy undervalue (negotiate a very good price and you have ‘instant equity’)

- increase the value via renovations or refurbishments

- ‘capital gains’ is a close 3rd but it can not be relied upon to build a portfolio quickly.)

Equity recycling requires you to build equity in your investment allowing you to pull out your initial investment. Using new 20% deposit investment options rapid equity recycling is possible again.

You will definitely still need to be skilled at investing, but it is doable if you put in the effort. For example, if you can buy a property undervalue by just 5%, and then add 15% by renovating you will have created equity of 20% ready to use to buy the next property.

Bank test rates (aka servicing rates)

The second half of the growth equation is your ability to service the debt. You may have been in the position where you make a great investment and are ready to recycle your equity out to buy your next property but the bank declines your application because of your servicing ability.

Behind the scenes, lenders are assessing your monthly income then subtracting your monthly expenses to calculate your UMI (uncommitted monthly income). They then take your UMI and see what repayments you can afford. This determines how much you can borrow and will differ depending on the bank or lender.

The magic for investors is hidden behind how our new lender calculates your monthly expenses, they calculate your existing mortgages at a lower test rate than the main banks.

Main banks are using a test rate of around 6.5% (at the time of writing), this makes it virtually impossible to find properties that will service themselves.

Banks also shade rental income to around 75% (feel free to discuss this in detail with an adviser), but basically, this means for your investment property to make a positive contribution to your portfolio’s servicing ability it needs to have a yield of 11%.

For example, if you had a UMI of $8,500 before counting any mortgage debt. If you have $1,000,000 of lending with a bank on a 25-year Principal & Interest loan at 3.95% the main banks would calculate that as a monthly cost of $7,228. Leaving you with a complete UMI of $1,272. With that, you could afford to borrow approximately $175,000.

Why are you here?

You are most likely reading our website because you have some questions about your mortgage, your rates or your options moving forward.

No one is going to pressure sell you anything on the phone.

You will learn your options, and if that is all that happens after you’ve invested 30 minutes of your time: You are going to sleep that night with the confidence you have everything set up correctly and a fair interest rate. Or maybe you discover you can buy that extra property – it could be the catalyst you’ve been hoping for. So don’t waste time wondering ‘what if’. The Mortgage Advisers at mhq.co.nz are friendly, approachable and knowledgeable. Have a look through the mortgage advisers available to you.

What is the bloody point anyway?

Financial Freedom! Most Kiwis will never have a system in place that delivers consistent income without much effort. If you want to have passive income that supports and enhances your lifestyle, especially as you get closer to retirement each day. A few property investments bought well, will improve your life.

Not sure where to start? We understand, that is why we have created a totally free 21-day property investing email course – check out what you could learn here.