Rules, strategies and tactics of the property investing game revealed.

Has anyone ever revealed the rules and tricks of property investing to you? Have you ever seen how property investors create $500,000+ of profit from single property purchase? We can show you the case studies.

Would you agree?

- Property investing can be extremely profitable.

- Property investing can be difficult.

- To keep building a portfolio it is key to access good mortgage rates.

- To build wealth, you will want both yield and capital gains.

- To reduce stress, you need cash flow.

Enjoy The Free 21 Day Property Investment Course.

If you agree, you have an idea to build wealth via property investment.

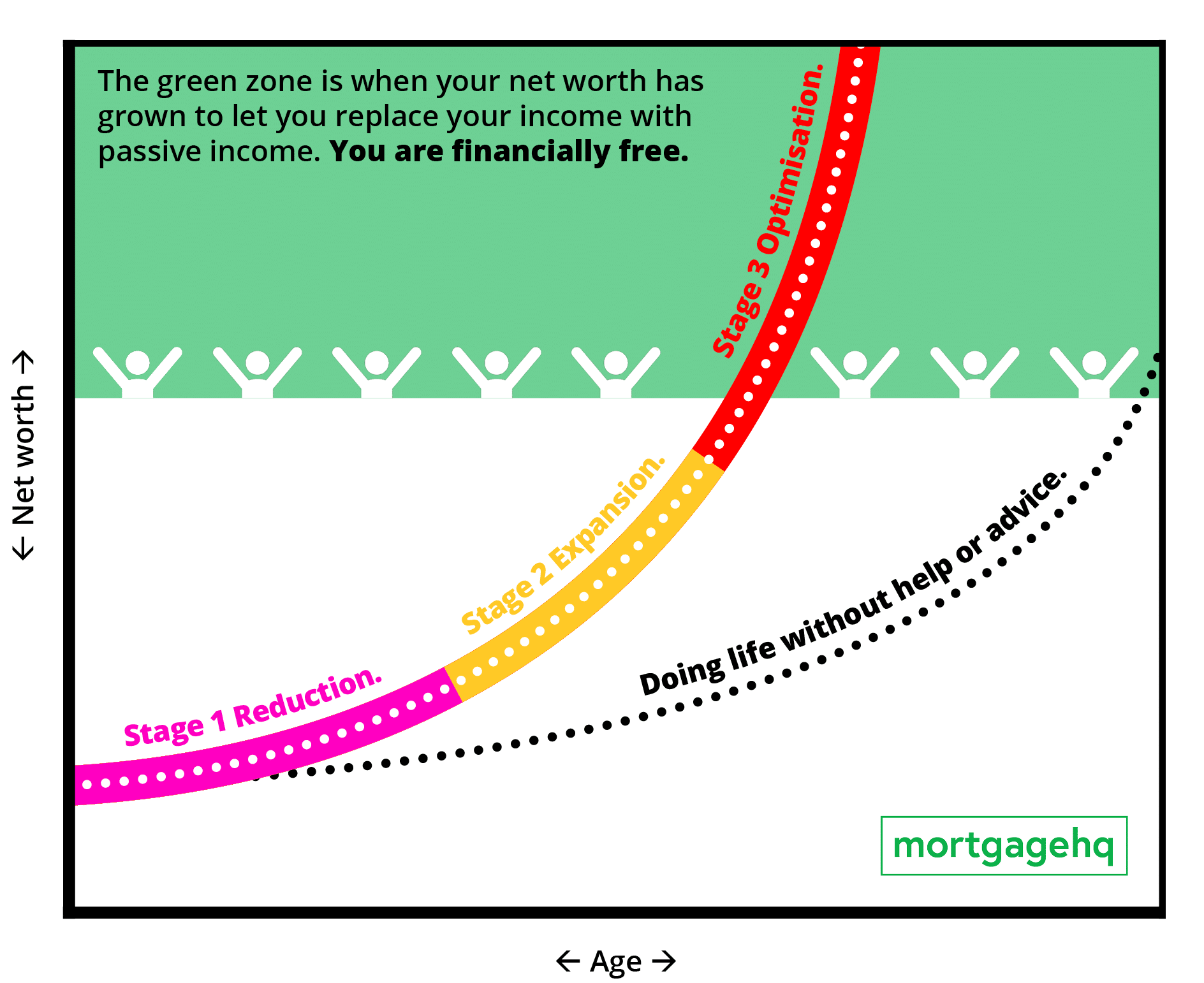

Stage entry: buying your first property.

Main goal: getting your home mortgage-free quickly, often in 10yr or less.

Stage entry: built up over $100,000 of available equity.

Main goal: refine your strategy for recycling equity, repeat, repeat, repeat…

Stage entry: $2,000,000 of equity across a portfolio.

Main goal: increase passive income, minimise time requirements, orchestrate big wins.

Hear from an expert for 3 weeks.

Some Of The Tips and Lessons You Will Learn Over The Next 21 Days…

- The 3 Most Important Criteria When Investing in Property

- The 2 Hidden Criteria For Successful Property Investing

- What does a successful property investment look like?

- The BRRRR Method – Property Investing made Simple

- House Hacking, Minor Dwellings, Home and Income and more

- How can you build up your deposit if you do not have enough cash or equity?

- Fishing NOT Hunting. Avoiding failure and mistakes with property investment

- How To Understand and Utilize Your Position For Maximum Results

- Where to buy – a focus on yields; net and gross

- What investment property to buy and how to decide

- How To Buy A Property

- ‘Why’ to buy your first/next investment property

- The ‘complicated’ property investment elements of tax, IO loans, etc

- The ‘complicated’ property investment elements of tax, IO loans, and the legal aspect

- How do the property investing experts build a larger portfolio

- Exit strategies before you sell a property and the pro vs con of cross security

- Should you bother with a pre-approval or not?

- The daily habits of successful property investors to find the ‘perfect’ property

- Understanding all the mortgage products and tricks on how to use them

- The ‘BEST’ mortgage structure for you

- How do I avoid risk? You are not alone – enlist others to help – the A-Team

Enjoy The Free 21 Day Property Investment Course.

In an effort to share as much information with you as possible. We are also hosting online events where you can watch and learn, then book a call to ask any questions you have – check the first email in the series for information on where to sign up.

We will take you through key concepts, ensuring you understand them and are positioned to implement them. Just like over 5,000 other people we have already helped review their situation and build their plan.

“Blandon was super helpful in explaining our mortgage options. Being an investor himself, he also suggested a couple of other fantastic investment strategies that really cemented and provided that clarity we needed for the next steps.”

Michael Ung (5 Star Facebook Review – 22 June 2020)

Join now to become educated, motivated and ready.