Most people use the words interchangeably. Technically a mortgage is security you give to your lender over your property. While a home loan is a loan the lender gave you to pay for your property.

Read on to understand exactly what a mortgage is, and exactly what a home loan is including the history of mortgages and their root words.

A mortgage (or home loan) is a loan from a bank or non-bank lender given to someone for the purchase of a property, that also entitles the lender security over the property to repossess it if payments are not met.

For those starting out on the property ladder, a mortgage can seem a daunting prospect. For most, a mortgage is the biggest financial commitment that they expect to make in their lives. Once you sign the paperwork, you are locking yourself into repayments for 30 years or so. To learn how to pay off your mortgage faster check out these masterclasses. Although the repayment length can differ, depending on your circumstances.

A lender can approve a mortgage once certain criteria are met. They will determine the level of risk that an individual or group of people have. This ultimately determines the amount that can be borrowed. Different risk levels may also change your mortgage interest rate.

For higher-risk individuals, or for those who choose a no or low deposit home loan, additional fees or mortgage lender’s insurance may apply.

If you’re unsure whether a home loan or a mortgage is right for your personal situation, one of our mortgage brokers at mortgagehq can help. We take a thorough look at your finances and guide you through making decisions that will benefit your future.

The 4 best definitions of the word ‘mortgage’ to help you best understand what exactly does mortgage mean.

What does mortgage mean?

When we ask, what does a mortgage mean, we are crucially asking, what is the purpose of it; what does a mortgage do?

To define a mortgage, therefore, is to say that it enables us to buy a property without having the entire sum readily available. It is a loan of money that you can receive from a bank or building society to buy a house. The mortgage is literally the instrument that secures the bank or lender to loan you the money and will allow them to take possession of the property if you fail to repay the loan.

Mortgage Definition

A conveyance of or lien against property (as for securing a loan) that becomes void upon payment or performance according to stipulated terms

Source: Merriam-Webster

Mortgage Loan Definition

A loan on real estate that is usually secured by a mortgage.

Source: Vocabulary.com

What is the Meaning of the word Mortgage?

A security, conveyance, lien, or claim on a property so the lender can take possession of a property if a loan is not repaid. Originating from Old French ‘morgage’.

What is the origin of the word mortgage, what is the etymology of mortgage?

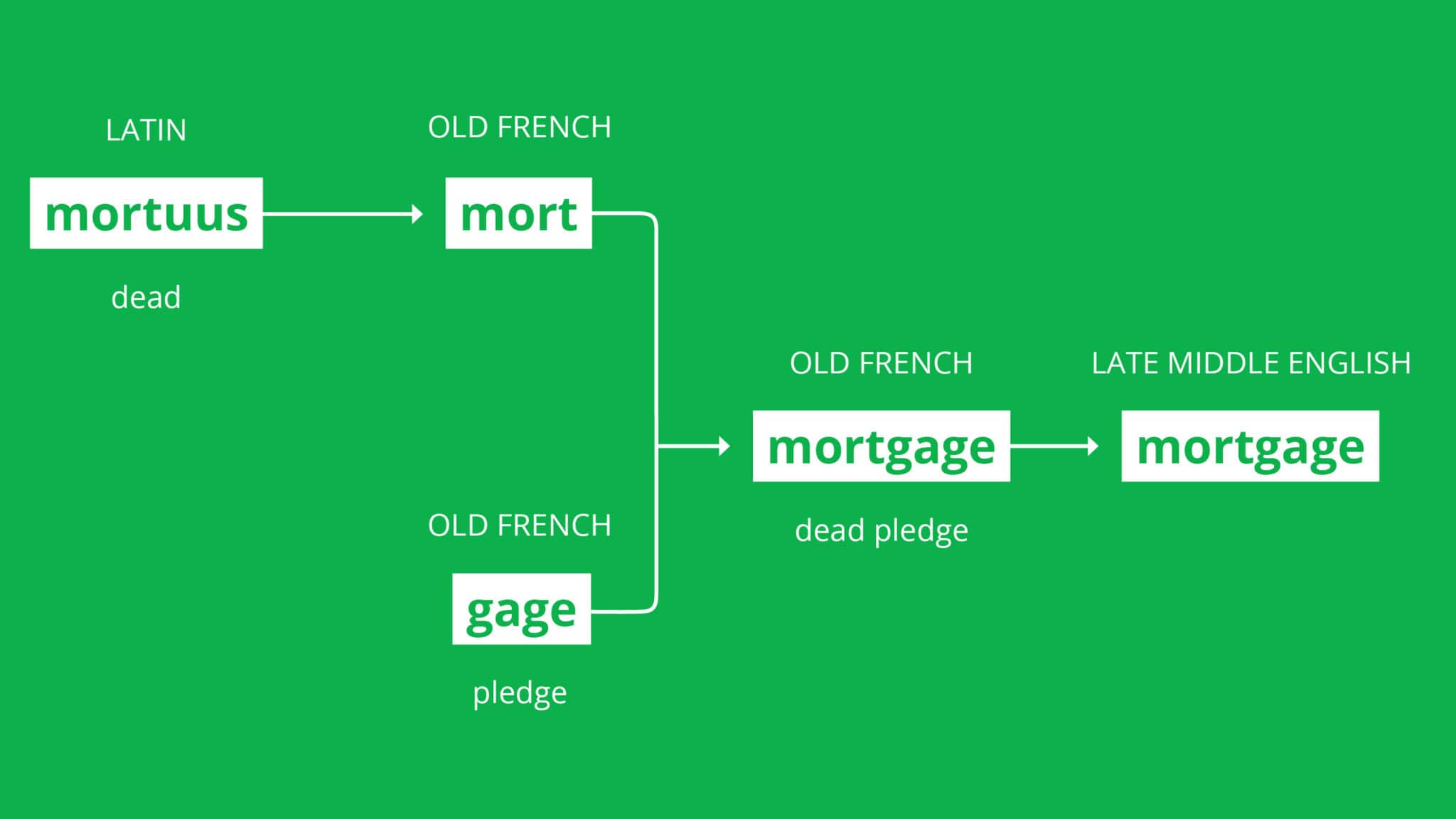

The origin of the word ‘mortgage’ comes from Old French ‘morgage’. For you word nerds out there, you might be noticing a disturbing and somewhat ironic root word in the term ‘mortgage’.

The origin of the word mortgage literally translates to ‘morg = dead’ and ‘gage = pledge’ to mean in English, ‘dead pledge’.

So, mortgage etymology describes the basic meaning and consequences of such a loan. The deal ‘dies’ when it is fully paid or when the repayments cease.

Because if we do not repay our mortgage and meet the agreements of the loan, then the property pledged is taken from us and is therefore dead to us. However, if we repay the loan in full, then the pledge becomes dead to the lender and the home becomes the sole possession of the owner!

History and invention of the mortgage.

Mortgages date back hundreds of years while the first was thought to have originated in England. The United States quickly caught on and records of such agreements are seen as far back as 1766.

They were smaller and simpler back then, but by the 1900s, more complex and longer-term mortgages were common. This was where only a monthly interest was paid whilst the borrower saved to repay the debt over time.

Historical key events such as the Great Depression and the World Wars led to many borrowers being unable to repay the interest accumulated on a loan. These loans unfortunately were for property that had lost its value, meaning that the loan was more than the current cost of the property.

This led to a change in how a mortgage was structured. Rather than simply repaying the interest, a part of the loan was also repaid in instalments and was fixed for between 20 to 30 years.

Paying a deposit for the loan offered lenders the security they needed to agree to the loan in the first place. It also reduced the amount borrowed, making it easier for a person to repay it.

Inflation rises of the 1970s altered mortgages into what we generally use today. It made them beneficial to both lender and borrower, rather than just the lender, as it was once seen to be.

Now you know what a mortgage is, do you want one? Or to restructure your one? There are different mortgage types that offer differing interest rates, fees and flexibility. It is up to you to determine what kind of mortgage best suits your situation. Support is available to help you make the best decision. Using a mortgage calculator for example, allows you to play around with different available options to plan your future accordingly.