Investing in property is a great way of saving for retirement and paying off the debt on your primary residence.

By using the equity in your existing property as leverage, you can buy an investment property using the banks’ money to increase your net worth.

You don’t have to invest in Auckland either. We’re starting to see massive gains in the regions and big growth is forecast for 2017!

The only money goal

So many people want financial freedom… but most do not take enough action to make it a certainty. Financial freedom means many different things to many different people, for some it is the ability to live 6 months of the year in Bali just working 6 months in New Zealand. For others, it is to retire in comfort. For others, it is to help their children in to their own homes.

Let’s break down a retirement dream, I want to retire when I am 55.

I would love to own my own home in the Eastern Beaches ($1,800,000).

I would love to own two new cars under warranty ($190,000).

I would love to own a launch ($320,000).

I would love to own a bach down in Onemana ($850,000).

I would love to spend $125,000 a year.

Okay well, we need to have enough cash to buy a house, two cars, a launch and a bach which is $3,160,000.

And investments earning $125,000 per year. If we assume a 5% yield that is $2,500,000.

Alright well, we best get saving… it is going to take a while to save up $5,660,000. In fact, if you are 30 like me, I have 25 years. So I need to save $226,400 per year… That’ll be difficult. Or if I save $50,000 per year, in the bank earning 2% interest. It’ll take me 58 years so I can just push off my retirement until I am 88…

Just kidding. Saving is not the answer.

If you want to retire. If you want financial freedom (ie the ability to earn money without working), you need to understand that you have to earn money without working.

You can’t keep trading time for money.

You need to start trading money for more money. So you need to invest.

But first. There are a lot of financial planners and wealth coaches who peddle this kind of example. But you don’t actually need that much money.

Aiming for financial freedom, where you have more money than you know what to do with, is not quite the right goal for most people. It’s too out of reach.

What most people should aim for is financial independence. Where your annual expenses including all mortgages, insurance, food, holidays, parties, etc are covered by annual recurring income – from property, business, shares or other investments. If you can build income streams that are passive (do not require much work from you) it will mean your time can be spent how you like.

The one money goal you need: make your passive income larger than your cost of living.

If you can identify now how much it costs you to live each year, you can work out your end goal and reverse engineer how to get there. Let’s say you need $100,000 a year for your family to live off if you have your mortgage fully paid down. This will be a good life.

Just work backwards from $100,000 to where you are now. Let’s assume you currently have 1 rental property bringing you $10,000 cash each year. It is obvious you will need to keep buying investments if you wish to increase your annual income.

The main thing you must have is a mindset of acquiring cash-producing assets and investments over the time window you have, whether this is 1yr, 5yr or 50yr, you must create habits that keep you focused on your income goal. Set up emails from trademe and realestate.co.nz that send you property info that meets your buying criteria. Learn about investing in shares.

Pick up some investment books. You can learn decades of investment lessons from 1000s of transactions in a matter of hours if you just read the books written by the experienced investors. You do not need to pay for a coach. Spend $100 buying 3 books and dedicate your leisure time to the pursuit of financial independence.

Unless you surround yourself with friends and family who share the same dreams as you, unless you focus every week on building up your knowledge, unless you learn about your target markets and take action, it’s not likely you will reach your passive income goals. It might not seem like you are making much progress but keep faith in your processes and work with mentors who will keep you accountable.

Now you know your passive income goal, a lot of people are wondering.

Should I invest in cash-producing investments or investments which grow in capital value?

Should I invest in shares or property? There is a great article to read right here which compares investing in shares, property.

How to buy a second property. Without any cash savings!

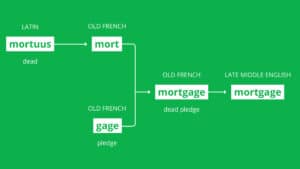

If you want to use equity to get a mortgage to purchase then you need to understand your borrowing power.

It can be confusing to work out how much equity you have in your property and how much is actually usable. As a rule of thumb, you must leave 20% in your property and this is unusable for borrowing purposes. So this means you could borrow up to 80% on the value of your family home and between 65-70% on your investment properties (or more if you use non-bank lenders). This is known as Loan Value Ratio or LVR and is one key step in calculating what size mortgage you can afford.

To work out your usable equity, take the value of your house and multiply by 0.8, then minus your mortgage. This money can be used as a deposit (along with other cash or equity).

Banks will look at a combination of factors including your equity and income to determine how much more you are able to borrow. Different banks/lenders will allow more or less lending depending on their lending and credit policy at the time of application. This can change daily. This means your current bank might actually not be the best place to help with new lending.

If you have a lot of equity and not much income, the bank will not lend, and vice versa… they are bound by the rules imposed on them. You might have options with non-banks though.

If you want to know what bank or combination of banks/lenders will lend you, the easiest way to find out is to ask a mortgage adviser like mortgagehq to run the numbers across all the different mortgage servicing calculators with your income, expenses and property info, and this will save you from damaging your credit score with full applications. It also saves you wasting your own time.

If you are curious about unlocking the ability to keep buying properties then check out Blandon’s analysis here:

But if you only have time for one video, check out his take on capital gains vs cash-flow. If you buy well and improve your properties, you just have to be a little patient and you’ll get your property portfolio built up over 5-20 years depending on your appetite for debt/risk.

This simple trick is used because it maximises returns and the amount you can borrow. You’ll probably already know interest rates are at historic lows, which is why so many homeowners want to learn how to buy a second house. Current market conditions make it harder for first home buyers, but it’s a great time to consider buying an investment property if you already own a home… because you can use “leverage”. ANZ (one of the many banks mortgagehq works with) describes this perfectly on their website:

“Leverage” is when you buy an investment property using borrowed money instead of using your own. The more you borrow, the more you’re said to be “leveraged”. Leverage is one factor that can accelerate your investment return. If your investment property goes up in value, the higher the return on the actual money you’ve invested.

Using your home as security, you’ll be able to borrow more money, because you’re leveraging to buy more investments that will help grow your wealth over the long-term. This is also known as “freeing up equity”. What’s the best way to increase your borrowing for a second house?

The best way to increase your borrowing for a second house

Now there are a few options; you can get finance approved at your current bank. This means using your equity and income to get pre-approval and that your properties will be cross-secured. You can read more about that here – it is not always the best thing because you’re more at risk of losing your properties if anything goes wrong.

Another option is to get a revolving credit for the deposit required for the investment property – as an example, let’s say you have a $200,000 mortgage and a $1.6mn house and you want to buy a $1mn investment property. You can in most cases use up to 80% lending on your owner-occupied property. So, in this case, your lending can increase up to $1,280,000 ($1.6mn x 0.80) but only if your income supports this lending. So you will have just over $1mn equity to go and buy another property that is 100% financed or…

You can get the deposit required for the $1mn investment property from your current bank (35% for investment properties based on the LVR rules of the time would be $350k) with a mortgage top-up or revolving credit and then get a pre-approval for the balance of $650k at another bank to avoid these properties being tied together. This helps for multiple reasons.

Whether you will move into the new house or not will influence the decision and we should talk specifics about that first. What you want to avoid is saying to the bank ‘my current house is about to become an investment property because I’m buying a new place’ because this will mean you bank will limit lending on that property to 65% of the value (as per guidelines/rules set by RBNZ). You should not lie to the bank and we are not allowed to do that, but you want to get your application ‘ducks in a row’ before saying anything you might regret.

The trick is often to consider a refinance of your current mortgage onto a lower interest rate and realise a higher valuation on the existing home. This will get you some cashback also. You might also consider restructuring or rebalancing your mortgage at the same time. This will help you get debt free faster or reduce your existing mortgage repayments while also re-valuing your property to increase your potential borrowing as a deposit for the second or third property (make sure you consider using a different bank as not to keep all of your eggs in one basket). The aim is to buy another property without needing any savings. Do not be afraid to extend your mortgage term again if required to free up some more borrowing power if this is the best way to get another property.

By breaking your mortgage and moving it to a lower rate, it hurts their profits. Refinancing can save the average Kiwi homeowner thousands of dollars in interest repayments over the remaining fixed term of their home loans. You could also knock years off your overall mortgage. Now if you are looking to extend your mortgage and increase your lending, you might actually have to take a longer mortgage on the original home to help you get the new borrowing and as a way to get the new house.

The reason it’s often suggested you break-and-refix or refinance to a new bank for lower rates and the mortgage top-up is you’ll have more bargaining power and usually get a better offer and some cash from the bank new bank to help you switch (for an unknown reason some banks seem to work harder trying to attract new business instead of trying to keep existing customers happy). Their loss, your win. You DO NOT have to change banks but it does sometimes make sense.

Your bank is NOT going to call you and say: “Hey, would you like a lower rate?”, because they would lose money…

Most of our clients save over $3,000 in less than 12 months by following our advice. A recent client of ours (a fireman) in Palmerston North is saving $22,845 over the next three years because he took our advice after a quick mortgage review. You can get free mortgage advice because banks pay our fees (don’t worry though we work for you, not for the bank). See how much you could save with a lower interest rate using our mortgage snapshot calculator.

The best way to buy a second home in New Zealand, and what the bank won’t tell you…

Here’s a real-world example: Patrick purchased a house three years ago for $438,000 with a 20% deposit making his mortgage around $350,000. In the last three years, Patrick has made the repayments to his mortgage and completed some renovations, and his equity has grown from 20% to 25% by reducing his mortgage to about $330,000. He then got a revaluation on his property and found that it’s now worth $830,000 meaning his equity has increased significantly and is now closer to 61% (because the mortgage amount is smaller in proportion to the house value). So he decided to buy another property. He can increase lending up to 80% on the $830,000 property meaning his has $334,000 of usable equity (plus the borrowing power for new lending).

Now, in theory, Patrick should be able to borrow up to 80% of the value of his primary home (80% of $830,000 is $664,000). He will keep 20% of his equity in his home to meet the reserve bank’s LVR limits. Using Patrick’s income and expense details, we showed him how to by another $800,000 property.

Making your repayments is just one way of increasing the equity in your home. With house prices on the rise across the country, and in Auckland, your property is likely to go up in value increasing your equity in the property also… this is referred to as capital gains.

Remember, the price you paid when you bought your home does not reflect the true value of your home today. When you fill out our online application, your properties will be automatically valued giving you an idea of their fair market value. Once you know what your properties are worth, you can borrow back up to the 80% equity mark (on your primary residence) and get this money into your bank account as revolving credit that can be used as a deposit for the second home. This is ‘free money’ because you only pay interest when/if you spend it.

This situation won’t last forever, and many experts will tell you a market correction could happen at any time. Revolving Credit is like a big overdraft, and you’ll only be charged interest on what you spend. You will need to have discipline with this privilege. Congratulations now that you have refinanced and topped up your mortgage, you now have a lower interest rate, and the deposit ready to go for your second home. It’s all a game to see how savvy you are. To succeed at property investing you have to know more than the average homeowner.

Once we know more about your current situation the strategies of negative gearing, capital gains, cash yields, renovations and revaluations will be explained in detail to you. A video series is in production to help you with this too. Unlike the property tutors you hear advertised on the radio/TV, we give this advice to you and our clients for free… we know it’s in our clients’ best interests to have all of this information available.

“Should I be converting my existing home into an investment property, or rent out my new property and stay put? Should I be using an LTC for tax purposes?”

These are harder questions to answer, but it’s best to think about your most important end-goal. Investors generally struggle with one of two things. Either, not enough income to borrow more money, or not enough of a deposit to buy an investment property. If you think you’ll be limited by your income, live in the property with the lower rental appraisal. If you think you’ll be limited by equity, live in the property with a higher valuation.

This makes sense because of the LVR limits imposed by the reserve bank on the big banks in New Zealand (ASB, BNZ, Westpac, ANZ, Kiwibank, etc). If you’re living in your most expensive property, you’ll be able to borrow up to 80% of its value. If you’re renting it out, you’ll only be able to borrow 65% of its value. Your goal should be to know which situation is going to work best for you before you start shopping for your next property.

How to become a ‘Property Investor’

Wealth and Freedom are ultimately the most important goals most Kiwis aspire to achieve. Whether you’re looking to retire early, have more income and time to spend travelling, or leave a legacy for your kids, property investment is a great way to make your dreams a reality. Aside from being a tangible investment, property is a great way of building a passive source of extra income.

Robert Kiyosaki’s Cashflow Quadrant does a great job of providing those who are aspiring to achieve financial independence with a framework for success. Your goal must be to move from the left-hand side to the right-hand side of the diagram below. The desired outcome is for your income to grow independently from the time and effort you spend at work.

Which quadrant describes you best, and where do you aspire to be?

The E (Employee) Quadrant

The E (“Employee”) makes money by “working for other people”. They usually go to the office every day and depend on monthly salary as a primary source of income. Employees rely on effort and time to make a lot of money. That is, to earn more, they need to work more and spend more time on work.

The S (Self-Employed) Quadrant

People who typically have professions and “own a job”, instead of working for other people, belong to the S or “Self-Employed” quadrant. Doctors, lawyers, and other professionals who “work for themselves” are examples of the ‘self-employeds’. Most ‘self-employeds’ do make a lot of money but, like the Employees, their income is directly tied to how much they work, so the moment they take a vacation or stop working, they practically earn nothing.

The B (Business Owner) Quadrant

Those belonging to the B (Business Owner) quadrant “own a system” instead of merely “owning a job”. They set up a way that makes money for them even if they do not spend a lot of time in the business. They achieve this by hiring Employees (who belong to the E quadrant).

Of course, when entrepreneurs start a business, a lot of time and effort is spent building it. In due time, though, when the system has been properly set up, the system is said to be “working”. The entrepreneur can now spend less time managing the business and yet his income is not reduced.

The I (Investor) Quadrant

Finally, those belonging in the I quadrant are called the Investors. They are usually:

- Most adept at making money work for them; and

- In some cases, they even use other people’s money to make more money.

The Investors mostly do not “work” at all, that is, they do not rely on personal time and effort to make money. They usually turn to stocks, fixed income securities, real estate, and other investment assets that produce income through capital appreciation, dividends, rental income, etc. In some cases, they merely entrust the management of these funds to competent fund managers who do the work for them. There’s one thing they all agree on, and that’s the magic of compounding, which drives the creation of wealth over long periods of time.