There has been huge publicity around the banks launching a mortgage holiday scheme. Should you jump at the opportunity of a holiday? Before you do – make sure you understand what it will mean.

UPDATE 1 APRIL 2020

Most banks have now started to refer to the government announced ‘mortgage holiday’ as a mortgage deferral.

We appreciate this change in vernacular.

What is a mortgage holiday?

What is switching to interest-only?

Mortgage repayments are typically made of two parts; 1 a principal repayment and 2 an interest payment. When you switch to interest only you are essentially taking a ‘holiday’ from repaying principal. While you are on interest-only your total mortgage will remain the same size and each payment you will only pay interest.

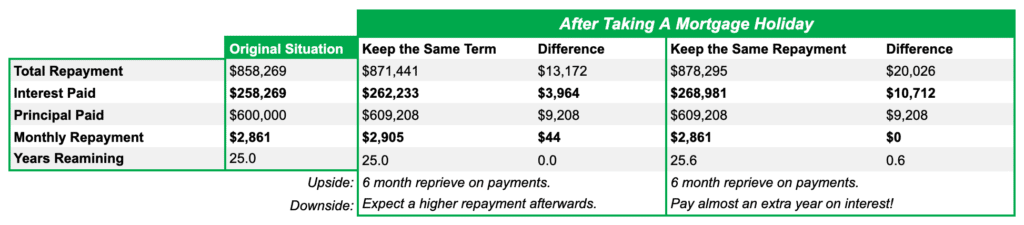

Comparing the two options.

Side by the side cost comparison for a $600,000 25 year mortgage on 3.19%.

Mortgage Holiday Calculator.

Mortgage Holiday Calculator Google Sheet Link (this will prompt you to login into your Google account and then create a copy of the spreadsheet for you to use.

Download/Create a copy of the calculator for you to use – plugin in your numbers and get actual facts!

Future impact.

Mortgage holiday won’t negatively credit rating – unless you miss payments once it resumes. However in the future when you apply for any new lending there are two parts to applications:

- The numbers, a mortgage holiday shouldn’t affect these.

- Diary notes, these are narratives where adviser describes you and can add mitigating factors: if you survive this without having to take a mortgage holiday – this will be a very positive factor moving forward.

Q. What other options are there?

A. Restructure to lengthen the term and tidy things up.

This is the ideal option to keep repaying your mortgage. It is also likely the right option if you have current personal debt.

Lengthening the term decreases your mortgage principal repayments, you can top up your mortgage at the same time if you need to secure access to cash.

You will probably only be able to restructure or refinance if your income has not been affected or only marginally changed. This is the ideal option but may not be realistic for many people at the moment.