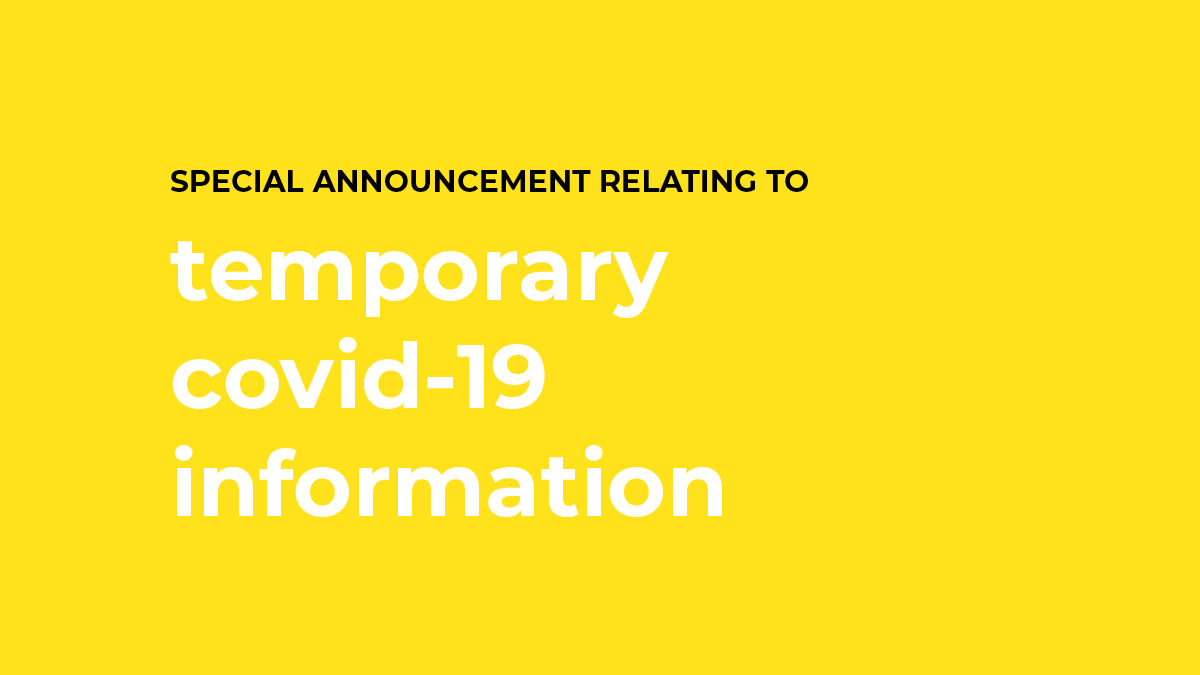

The Government, retail banks and the Reserve Bank are today announcing a major financial support package for home owners and businesses affected by the economic impacts of COVID-19.

The package will include a six month principal and interest payment holiday for mortgage holders and SME customers whose incomes have been affected by the economic disruption from COVID-19… “A six-month mortgage holiday for people whose incomes have been affected by COVID-19 will mean people won’t lose their homes as a result of the economic disruption caused by this virus,” Grant Robertson said.

The specific details of this initiative are being finalised and agreed urgently and banks will make these public in the coming days.

The Reserve Bank has agreed to help banks put this in place with appropriate capital rules. In addition, it has decided to reduce banks ‘core funding ratios’ from 75 percent to 50 percent, further helping banks to make credit available.