Whose side are Mortgage Brokers on?

Mortgage Brokers are often free....

Once you’ve figured out that the ‘free’ service you get from a mortgage adviser is actually because they get paid by the banks that they hand you over to, you might start to wonder such thoughts as:

- If the bank is paying the mortgage broker… does that mean they are on the banks’ side and not mine?

- Do mortgage advisers look out for me, or are they focused on their commissions from the bank?

- What does a mortgage broker do, anyway?

A free service to you is always, naturally, going to be enticing. Rightly so. Especially when you’re in the midst of hard deposit saving or curbing your expenses.

If you’re able to find a way to make your money work for you without spending that money, you’re onto a winner. Mortgage advisers, with their robust connections and wealth of knowledge, simply offer the potential of reward without any of that risk.

But does a mortgage broker offer you completely unbiased support or does the free service actually come at a cost that’s not seen until years down the track?

What is a mortgage broker?

A mortgage broker is someone who bridges the gap between lender and borrower. They help banks and borrowers connect the dots and find the best pathway forward. Banks can be uncompromising to people inexperienced with home loans or simply trying to do it on their own. The times where a mortgage broker has been able to secure a home loan for their client, when previously they were declined, are innumerable. As mortgage brokers only get paid for successful outcomes, they typically try harder than a salaried employee working at the bank.

Mortgage brokers also shop around for the best mortgage interest rates, terms and deals for their clients. These differ between each individual, whether it is their first home loan or subsequent mortgages.

Just because you were able to secure a home loan with one bank, does not mean that you should remain with them until your loan terms have been fulfilled. Many people wash their hands of the complicated process after securing a home loan. But refinancing could save you $1000s and your mortgage broker is able to back this claim up with some well documented, bespoke statistics and case studies.

If you have concerns, considerations or questions about your current mortgage and are curious about your options, then by speaking to a mortgage broker, you gain valuable insight and support to help you to make the right decisions.

Let’s get clear about a mortgage advisor’s legal requirements.

Although paid by banks and non-bank lenders, a mortgage broker is licensed under the Financial Services Providers Register (FSPR) which is regulated by the Financial Market Authority (FMA). As such, they have a set of requirements which they must abide by. It doesn’t matter who pays mortgage brokers, these requirements are aligned with what their role ultimately entails. That is, to serve their client.

The FMA regulates and monitors the financial markets in New Zealand. The initial police check knocks anyone dodgy out of becoming a financial adviser, then the education requirements make it tougher for anyone unqualified or lacking in knowledge to be in position to provide advice. After getting a criminal check clearance, getting your qualifications verified and completed, you then have to get accredited with individual banks which is a big hurdle in itself – many brokers only ever achieve accreditation with several banks.

A mortgage broker is tasked to find the best deal across all financial institutions for their client, without having financial ties to any one specific lender. You can actually read the code of conduct brought in to help guide advisors on their desired behaviour to focus on client outcomes above all else.

You can be assured that to continue legally practicing as a mortgage broker, these professionals need to remain unbiased and completely transparent about what information they have been able to source for you.

A mortgage broker will use their vast stores of experience and knowledge to find the ideal relationship with a lender for their client.

What will the best mortgage broker do for me?

Let’s be clear, a mortgage broker cannot conjure up a magical lender with perfect products and services available. They can only work with the reality of what is available.

They themselves are not lenders so cannot guarantee you a home loan.

The best mortgage brokers, however, have connections with more lenders than you thought available, so we may be able to find you an option when you thought all resources were exhausted. Any mortgage adviser working on a large volume of deals is going to have direct connections with key bank staff, this helps things move smoothly for you.

For example, if you do not have the required 20% to 40% deposit for a mortgage, or were unfortunate enough to be caught in the middle of recent changes, we are able to quickly source other options. There may be an alternative bank to look at, or a non-bank lender which may not be as competitive as traditional bank mortgage rates, but still allow you to purchase a property.

After some time, we can reassess your situation as any of the best mortgage brokers would be able to do. We would be ready to facilitate you making a move when the time is right to reduce any unnecessary costs as much as possible for you.

Although we have an excellent reputation, both with our customers and with the many lenders across New Zealand, emphasis on ongoing support and education beyond your initial mortgage is where we excel. We aim to provide everything we can for our customers to walk their path to financial freedom.

Beyond securing your lending – mortgage advisers should be asking you questions. You should not have to ‘know what you don’t know’. A good mortgage broker will proactively point out options and explain them to you. They should be talking to you about: interest rate averaging, revolving credit accounts, potential future implications and more.

How to choose a mortgage advisor?

Typically, you’re going to find a mortgage advisor online or get referred to someone. Referrals are often highly trusted but can be manipulated. Some examples to look out for are kickbacks or incentives you are unaware of: property coaches getting paid by developers, mortgage brokers getting paid by real estate agents, real estate agents getting paid by mortgage brokers etc. Check out this warning from Consumer NZ about referrals.

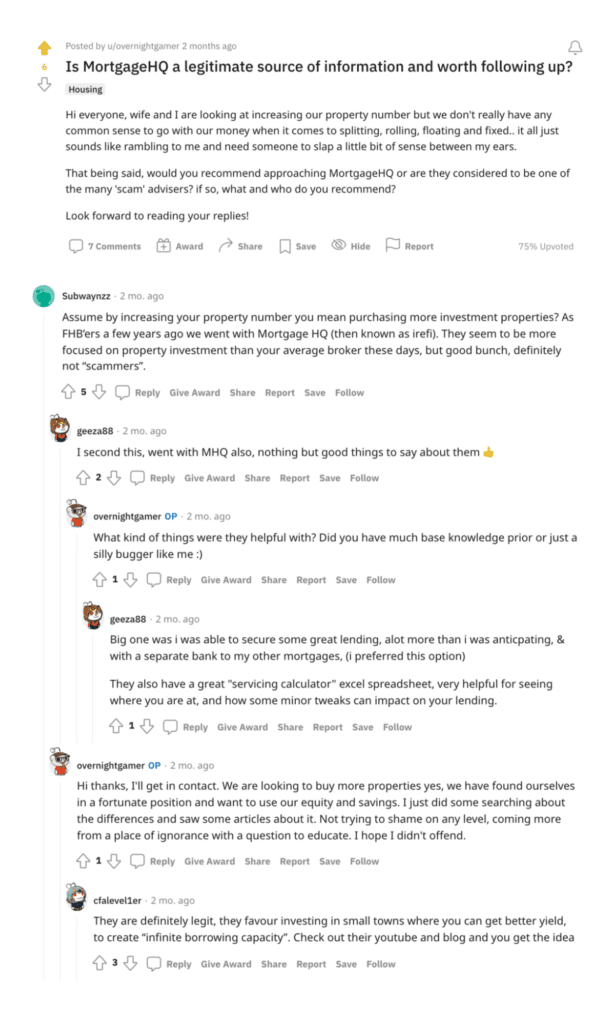

You don’t need to find a ‘good’ mortgage adviser, you need to find the right mortgage adviser for your situation. By looking over some reviews and whether they have awards and relevant experience to their name, you’re going to get a feeling for who it is you should be talking to. You can also search or ask online like on Reddit.

Don’t be afraid to approach several mortgage brokers. Find someone who you feel comfortable with, who empathizes with your goals and is motivated by your situation.

The relationship that you have with your mortgage advisor should be one that lasts for many years, not like when you call the bank and you don’t know who you are going to get.

If you can find a solution with a provider that has hundreds of happy clients already, you’ll probably feel safer than working with the smaller or newer companies where advisers probably deal with less volume and don’t have as much experience.

Our award winning mortgage brokers can help!

To talk with someone from our team, book a 10-minute introductory call. This is a no-pressure, no-obligation call. Our team will help you clarify your situation and goals, and then when you are ready he will match you with an adviser from our team.

What is the difference between a Mortgage Adviser and a Mortgage Broker?

These two terms float around interchangeably which can get a little annoying at times. We ourselves have done it here in this article. Does that mean that an advisor and a broker are the same thing? Or do people simply not recognise the difference when talking about them, confusing the professions?

An advisor or a broker do the same thing. We could say that there is emphasis on different aspects of the overall role. One professional may prefer some elements of their job and therefore refer to themselves as either a broker, or an advisor. Some may work entirely remotely as an online mortgage broker or others could operate more comfortably in person.

To elaborate, a mortgage broker is going to help you secure the best offer in the market. Whether it is an existing mortgage that needs refixing or refinancing or a new mortgage you are looking at taking.

They negotiate interest rates, cash-back incentives and mortgage structure (product) options. You should think of the mortgage broker’s role as more transactional and time sensitive.

A mortgage advisor does all of these things, but is also going to focus on the long term goals and options. This help always starts with identifying your goal(s). They’ll specifically ask, “Hey, what’s your goal?” Then offer to help you reach that goal. If you don’t know your goal then they’ll help you think about it some more and get that goal vocalised and written down.

Both words ‘adviser’ or ‘broker’ describe the same profession, so if you are looking at someone who chose one description over the other, then it probably signals the type of work they enjoy doing and how they will approach your situation.

At mortgagehq we identify as a company that has moved past just being mortgage brokers through to being mortgage advisers. We’ve got very good at broking deals and now we’re focused on helping clients over the long term to build income for life through property investing and smarter mortgage structures.

How many of mortgagehq’s advisers are recognised as Top Mortgage Brokers?

The 2021 awards are out. Blandon and Zhiyang were all individually awarded ‘Top Adviser Status’ by NZ Adviser for the volume of work done for clients during the 2020-2021 Financial year.

As for the top mortgage brokers in Auckland, mortgagehq has been included in an esteemed list that reviews pretty much every experience in New Zealand, whether it is home loans or washing machines. We are in the top 9 list of mortgage brokers Auckland for Top Reviews NZ and make the top 3 for MoneyHub.

Since starting this company in 2015, Andrew and Blandon have strived to build a platform that educates their clients and supports them throughout their entire home ownership and property portfolio experience. Advisors on the team are not solely trained with their marketing and strategy. They are taught smart mortgage use, are chosen for their passion for property investment and home ownership and are given the tools to provide their clients with education to help themselves.

This is how mortgagehq continues to climb from strength to strength. This is why reviews are consistently excellent and why this company and its clients will keep succeeding, regardless of the economic ups and downs we are faced with throughout time.

Our award winning mortgage brokers can help!

To talk with someone from our team, book a 10-minute introductory call. This is a no-pressure, no-obligation call. Our team will help you clarify your situation and goals, and then when you are ready he will match you with an adviser from our team.

How much does a mortgage broker cost? Are there free mortgage brokers?

A mortgage broker is usually a free service. Occasionally there are some nominal fees, but these are transparent and discussed should they be applicable to you. They generally occur when specific, time consuming work is done for you without any compensation from a bank. There are often fees for pre-approvals.

What’s important is that your mortgage advisor has access to all of the main banks here in New Zealand and the different lenders, not all brokers work with all lenders. At mortgagehq we can access over 28 lenders for you.

Your advisor has an incentive to get you a result, so they’re going to see it through all the way to the end. If something needs to be done at 9:00 at night, or on a Saturday or Sunday, then a mortgage broker has this big incentive to get something done for you because, basically, that’s how they’re going to get paid.

Auckland Mortgage Advisers?

Mortgagehq is based in Auckland, our mortgage brokers work from an office in East Auckland. However we have been working virtually since ‘before it was cool’.

Most clients don’t connect with us face to face, as it is usually unnecessary and can slow the process down. We have clients using us as their mortgage broker from around the country, you don’t need to be in Auckland to access our advice.

Do you need a mortgage advisor?

Whether you’re looking to secure your first home loan or are trying to find ways to make use of the equity in your home, then a mortgage broker is someone who you can approach for free, professional advice and support.

You’ve learned that the terms advisor and broker are interchangeable, however an advisor may be more willing to establish a long term relationship with you to enable you to achieve your financial goals. A broker is a professional who is focused on finding you the best possible deal in regards to your mortgage. These definitions are not set in stone and are simply an assessment of each title, so get to know the professional you wish to work with through phone calls or face to face chats to determine whether you’re a good match for your goals.

If you’re prepared to commit to your home ownership and property investment journey, there are some questions your advisor is likely to ask you. Be prepared before your initial meeting with basic information like your name, address, mortgage details, income expenses and so forth.

With this information we can assess your current situation and what options are available to you. We can calculate your borrowing power, see what your uncommitted monthly income could be and get to know you a little better before we begin talking seriously.

By getting these questions out of the way before your meeting, we don’t need to go through this time-consuming scenario. Rather, your appointment will be about aligning goals and establishing potential challenges. If we both feel comfortable to continue, we will request all of the documents the bank will ask for in an application, such as bank statements and payslips.

Our team begins collating the information, reviewing it and submitting it to the bank through the broker channel. It is a time sensitive process but having a team on board makes your application both less burdensome and more effective for you. Find out more about our mortgage advice process here.

If this sounds like something you’re eager to experience so that you can reap the rewards that property investment has to offer, then you are going to want to speak with a mortgage advisor. Book in a 10-minute introductory call today.

Whether you’re looking for education on how to use the equity in your home or how to become mortgage free faster, or are seeking a way into the property market, we have the team and online education to make it happen.