Government 6 month mortgage holiday

Most banks have now opened an application form on their websites to apply for mortgage holidays – we would recommend going directly to your bank if this is the option you want to take.

Note the details are still being worked out and are yet to be fully announced, but it is going to be restricted to those whose income has been affected by Covid-19. Judging by the other subsidies in place we predict it to be restricted to those who have lost a percentage of income – perhaps 30%.

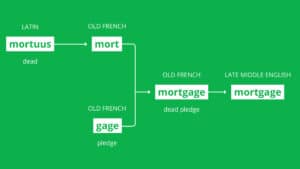

A mortgage holiday works by pausing repayments, however, the interest is still applied and added to your mortgage total – this means your mortgage will grow whilst you are on the ‘mortgage holiday’. Please don’t view it as a genuine holiday – you will still have to pay it later.

Bank policies right now

We are seeing banks become open with both mortgage top-ups (in the range up to $50,000 with the reason being ’emergency money for covid-19) and temporary switching to interest-only products.